Gemini Strategist Report: Decoding Alphabet’s Google I/O 2025 & Future Growth Trajectory

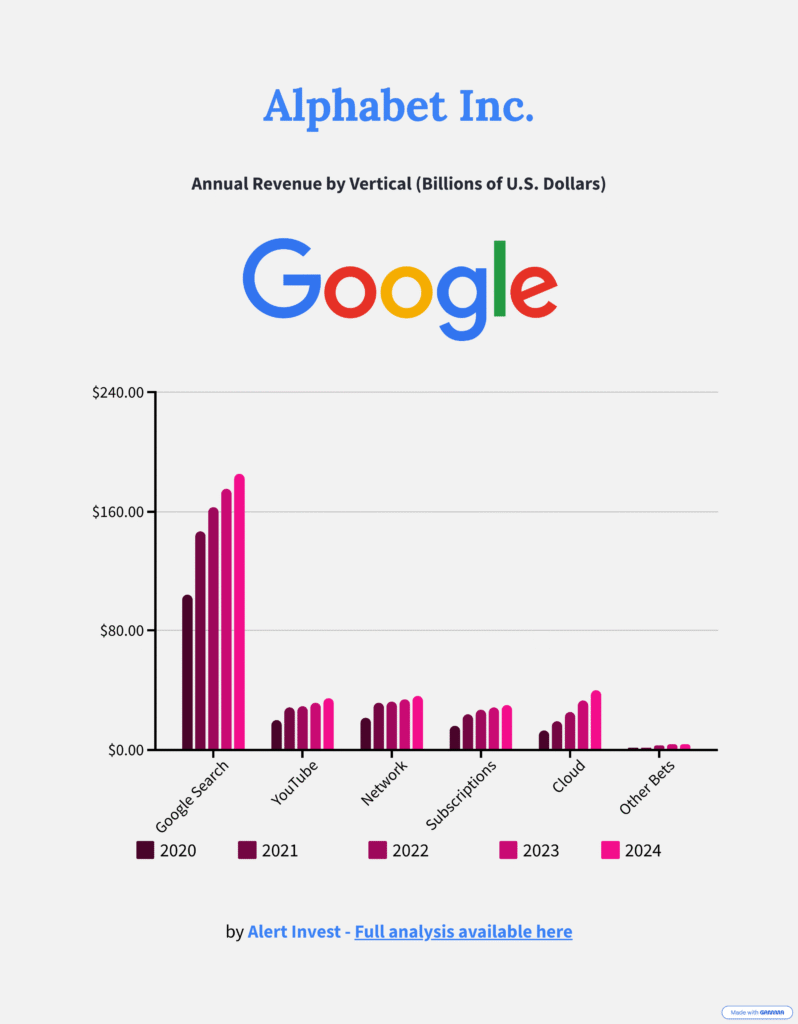

Company:Alphabet Inc. (NASDAQ: GOOGL, GOOG)

Analyst:Gemini Strategic Insights

Event Focus:Google I/O 2025 Key Announcements

Key Themes:AI Supremacy, Search Evolution, Agentic Computing, Developer Acceleration, Next-Gen XR, Alphabet Valuation Drivers

Overall Outlook:Strategically Bullish on AI initiatives impacting intrinsic value; Execution & Competition Critical

Analyst Sentiment (May 2025):Generally Buy/Strong Buy on Alphabet (GOOGL). Q1 2025 growth positive. I/O 2025 AI innovations key to unlocking further intrinsic value. Valuation appears compelling relative to AI-driven growth prospects.

Executive Summary: Alphabet’s AI-Powered Future Unveiled at I/O 2025 & Valuation Impact

Google I/O 2025 underscored Alphabet’s deep commitment to embedding Artificial Intelligence across its entire product ecosystem, positioning AI as the central nervous system for future growth, innovation, and ultimately, its intrinsic value. The announcements, spearheaded by Gemini 2.5, signal a strategic intent to defend core markets and pioneer new frontiers, potentially highlighting areas where Alphabet might be undervalued. This report analyzes the five most pivotal announcements, their market context, their potential to create a significant competitive edge, and their implications for Alphabet’s valuation, all viewed through an equity strategist’s lens. Our analysis aims to be insightful yet accessible, focusing on what truly matters for investors and tech enthusiasts alike.

1. Gemini 2.5: Foundational AI & Alphabet’s Intrinsic Value

Analyst Quick Take: Gemini 2.5 isn’t just an upgrade; it’s Alphabet’s strategic play to dominate the AI landscape. Its advanced capabilities are crucial for enhancing all Google services and significantly boosting Google Cloud’s appeal, directly fueling Alphabet’s long-term intrinsic value and challenging any “undervalued” thesis.

Strategic Impact & Market Explosion Potential

As Google’s most advanced AI, Gemini 2.5’s improved reasoning (“Deep Think”), enhanced multimodality, superior efficiency, and increased user control will serve as the bedrock for next-generation AI features across all Google products. Its superiority is expected to drive user experiences and empower developers, leading to widespread adoption and profound market impact.

Alphabet’s Competitive Edge

Owning a leading-edge, highly capable, and efficient foundational AI model provides the ultimate competitive advantage. It allows Alphabet to innovate faster, differentiate its products significantly, and offer capabilities that are difficult for competitors to match. This technological lead is a core component of its long-term intrinsic value, reinforcing its market leadership.

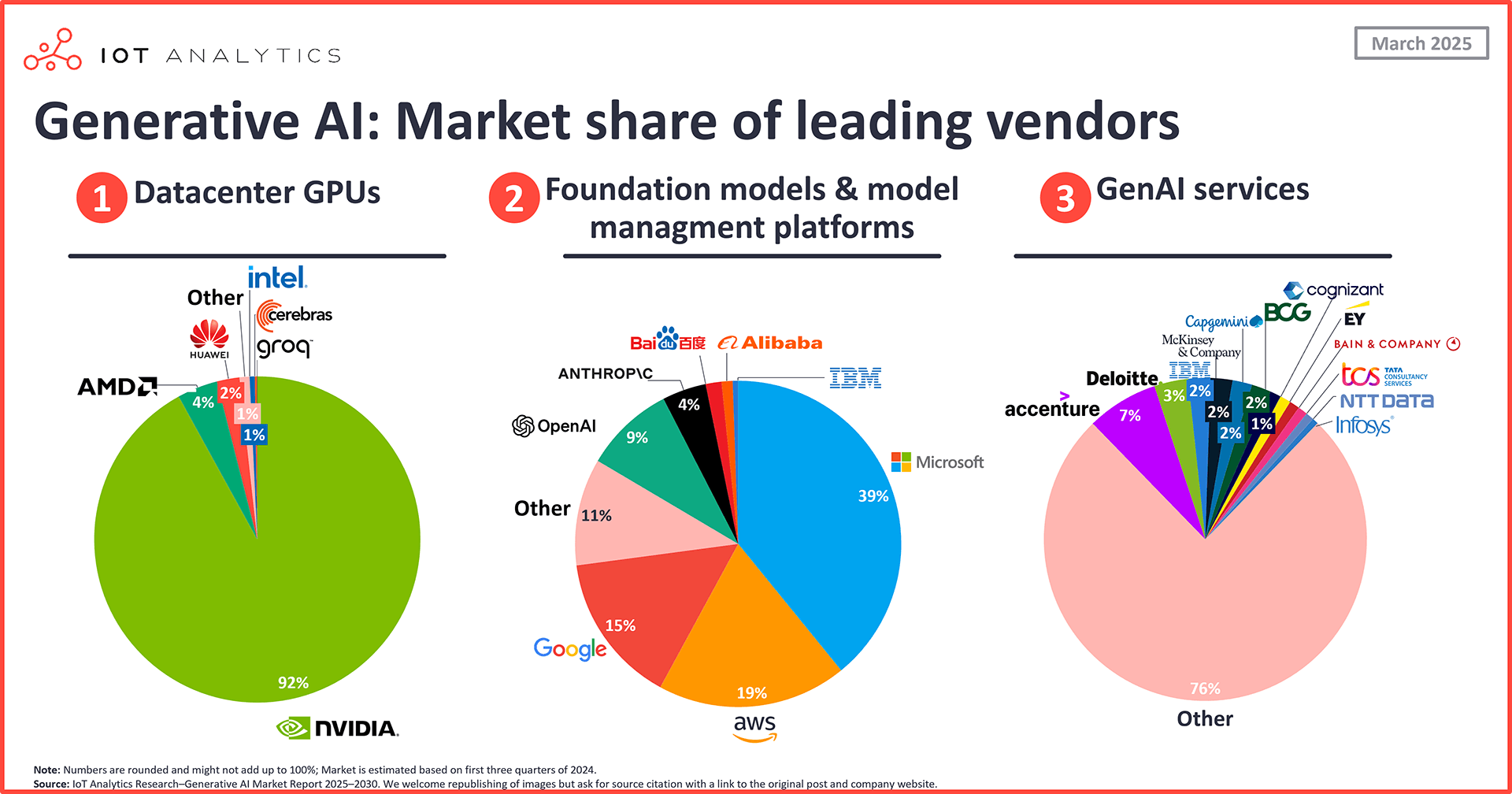

The Generative AI market is projected for explosive growth (potentially >USD 1T by 2034). Pretrained AI models: USD 536.6M in 2025, to USD 1.27B by 2032.

Key Competitors & Indicative Share (Early 2025): Microsoft (OpenAI) ~39%, AWS (Anthropic) ~19%, Google (Gemini) ~15%. Highly dynamic.

Equity Analyst/Strategist Perspective: Gemini 2.5 & GOOGL Valuation

Strategic Imperative:

Demonstrating AI leadership is paramount for sustaining a premium valuation. Gemini 2.5 is Alphabet’s direct response to establish clear differentiation, securing critical infrastructure for the AI era and bolstering its argument against being undervalued.

Upside Potential & Monetization:

Expect enhanced product value across Google services, Cloud AI leadership via Vertex AI (driving GCP revenue and impacting Alphabet’s valuation positively), new revenue from premium Gemini capabilities, and cost efficiencies. These factors directly contribute to a higher intrinsic value.

Risks & Competitive Dynamics:

The blistering pace of AI innovation means rapid model obsolescence is a threat. Intense talent wars, potential monetization lag against high R&D costs, and robust open-source competition (e.g., Meta’s Llama) are risks that could temper valuation growth if not adeptly managed.

Key Performance Indicators (KPIs) for Investors (Valuation Context):

Monitor Vertex AI adoption and its impact on GCP’s revenue contribution. Track Gemini API usage, independent performance benchmarks, and cost efficiencies reflected in margins. These are crucial signals for assessing if GOOGL is undervalued.

2. AI Mode in Search: Defending Core Valuation Driver

Analyst Quick Take: AI in Search is Google’s crucial play to protect its cash cow. Successful integration will not only defend its massive advertising revenue—a cornerstone of its current valuation—but could also unlock new monetization avenues, reinforcing its market dominance in the AI era.

Strategic Impact & Market Explosion Potential

By deeply integrating Gemini 2.5, AI Mode (including Deep Search, AI Overviews, and agentic shopping) will redefine how billions interact with Google Search. It aims to deliver more intelligent, conversational, and actionable results, leveraging Google’s unparalleled scale for massive user impact.

Alphabet’s Competitive Edge

This is a critical defensive and offensive move. It protects and evolves Google’s primary revenue engine against emerging AI-native search alternatives and chatbots, ensuring Google Search remains indispensable and a core component of Alphabet’s valuation.

The AI Search Engine market is projected to reach USD 108.88 billion by 2032.

Key Competitors & Indicative Share (Overall Search – Early 2025): Google ~89-90% (traditional search dominance vital to GOOGL valuation); Microsoft Bing (Copilot) ~3.9%.

Equity Analyst/Strategist Perspective: AI Search & GOOGL Valuation

Strategic Imperative:

Protecting the search advertising revenue stream is existential for Alphabet’s current valuation. AI Mode is designed to ensure Google Search maintains its supremacy as the primary information gateway in an AI-first world.

Upside Potential & Monetization:

Increased user engagement, higher ad value through superior intent understanding, new ad formats within AI Overviews, and a reinforced market moat are significant opportunities. Success here could compellingly argue that GOOGL is undervalued, especially if AI search enhances profitability.

Risks & Competitive Dynamics:

Risks include potential ad click cannibalization, the high computational cost of AI queries, the critical need to maintain accuracy and user trust (avoiding “hallucinations”), and ongoing regulatory scrutiny of search practices. These factors could challenge the core valuation thesis if not managed effectively.

Key Performance Indicators (KPIs) for Investors (Valuation Context):

Closely watch search query growth, user engagement metrics, paid click growth, and CPC trends. Monitor AI Overviews adoption, impact on referral traffic, and the cost-per-AI-query versus revenue generated. These all feed into models of Alphabet’s intrinsic value.

3. Agentic AI: Unlocking New Dimensions of Value

Analyst Quick Take: Agentic AI (like “Agent Mode”) is Alphabet’s ambitious step beyond search, aiming to create indispensable AI assistants. Success could create profound ecosystem lock-in and unlock entirely new revenue streams, significantly rerating Alphabet’s long-term growth and intrinsic value potential.

Strategic Impact & Market Explosion Potential

Initiatives like “Agent Mode” and Project Mariner signify a transformative shift from AI as an information provider to an AI that actively performs tasks for users. If adopted, this offers immense utility and will deeply embed Google’s AI into users’ daily lives, creating new interaction paradigms.

Alphabet’s Competitive Edge

Becoming the primary AI agent for users creates an incredibly strong moat. It fosters deep ecosystem integration, enables hyper-personalization, and centralizes Google’s role in how users interact with technology and services, opening new avenues for value creation beyond current market assessments.

AI Agents market projected for rapid growth (USD ~50B by 2030, potentially ~USD 230B by 2034). Voice Assistant market: USD 44.26B in 2025.

Key Competitors (Voice Assistants – Early 2025): Google Assistant ~35%, Amazon Alexa ~30%, Apple Siri. Microsoft Copilot emerging.

Equity Analyst/Strategist Perspective: Agentic AI & Future Valuation

Strategic Imperative:

This initiative aims to make Google’s AI the central operating system for users’ digital lives. It’s a paradigm shift beyond current search-centric models that could significantly rerate Alphabet’s growth narrative and, consequently, its intrinsic value if successful.

Upside Potential & Monetization:

The upsides are substantial: strong ecosystem lock-in, new subscription opportunities for advanced agent capabilities, hyper-personalized e-commerce facilitation, and a powerful data flywheel for continuous AI improvement. These could unlock future value not currently priced into GOOGL stock.

Risks & Competitive Dynamics:

Significant hurdles include the high complexity and reliability challenges of building truly autonomous agents, paramount privacy and security concerns with increased data access, navigating user adoption curves for task delegation, and intense interoperability battles (walled garden vs. open standards).

Key Performance Indicators (KPIs) for Investors (Valuation Context):

Monitor adoption rates of new agentic features, the complexity of tasks users delegate, user satisfaction and trust ratings, third-party integrations, and any early monetization models. These are crucial signals for assessing if this new frontier could prove Alphabet is undervalued.

4. Firebase Studio & AI Developer Tools: Building Blocks for Value

Analyst Quick Take: Empowering developers with advanced AI tools like Firebase Studio is a shrewd move. It accelerates innovation on Google’s platforms, directly fueling Google Cloud’s growth—a key area analysts watch closely for Alphabet’s overall valuation expansion.

Strategic Impact & Market Explosion Potential

Providing developers with intuitive, powerful AI tools such as Firebase Studio and autonomous coding agents like “Jules” will catalyze an explosion of AI applications on Google’s platforms (Android, Web, Cloud). This dramatically lowers barriers to entry for creating sophisticated AI-driven experiences.

Alphabet’s Competitive Edge

Winning the AI developer platform war is crucial. Superior tools aim to make Google’s ecosystem the default choice for building next-generation AI applications. This directly drives Google Cloud adoption—a key growth area for Alphabet’s valuation—and enriches its consumer platforms with cutting-edge AI features.

AI Platform Market to reach USD 108.96B by 2030. GenAI Coding Assistants: USD 139.55M by 2032 (CAGR 25.4%).

Key Competitors (Cloud AI – Early 2025): Microsoft Azure (strong GenAI momentum), AWS (leading overall cloud share), Google Cloud (aggressively advancing AI tools, critical for its valuation narrative).

Equity Analyst/Strategist Perspective: Developer Tools & Cloud Valuation

Strategic Imperative:

Securing the AI developer ecosystem is vital for Google Cloud’s growth and its increasing contribution to Alphabet’s overall intrinsic value. Tools like Firebase Studio and Jules are designed to make Google’s platforms the preferred choice for innovation.

Upside Potential & Monetization:

Increased Google Cloud consumption is the primary driver. Stronger Android/Web ecosystems, potential for premium developer service revenue, and attracting top AI talent and startups all bolster GCP’s growth story and thus Alphabet’s broader valuation potential.

Risks & Competitive Dynamics:

Intense competition from Microsoft (Azure AI, GitHub Copilot) and AWS (SageMaker) is a constant. Ensuring developer loyalty through tangible productivity gains, managing the inherent complexity of AI development, and challenges from compelling open-source alternatives could impact market share gains in this valuation-critical segment.

Key Performance Indicators (KPIs) for Investors (Valuation Context):

Track active developers on the platform, Google Cloud AI service revenue growth, the number of new AI apps on Android leveraging these tools, and developer satisfaction scores. These are indicators of ecosystem health and future monetization potential for GOOGL’s Cloud unit.

5. Android XR & Gemini: A Long-Term Valuation Catalyst?

Analyst Quick Take: Android XR with Gemini is Alphabet’s strategic, long-term bet on the next computing wave. While still nascent, success here could unlock a significant, currently underappreciated, new dimension to Alphabet’s intrinsic value, offering a compelling “call option” for investors.

Strategic Impact & Market Explosion Potential

Google’s renewed push into Extended Reality (XR) with its Android XR platform, deeply integrated with Gemini AI and supported by key hardware partners like Samsung and Xreal, aims to catalyze mainstream adoption. The focus is on creating contextually aware, AI-native immersive experiences that feel intuitive and genuinely useful.

Alphabet’s Competitive Edge

This is a strategic long-term play to secure a central role in what could be the next major computing platform. Leveraging Android’s ecosystem strength and Gemini’s AI capabilities positions Alphabet to capture significant market share in the nascent but potentially enormous XR market. This offers a substantial “call option” on future intrinsic value.

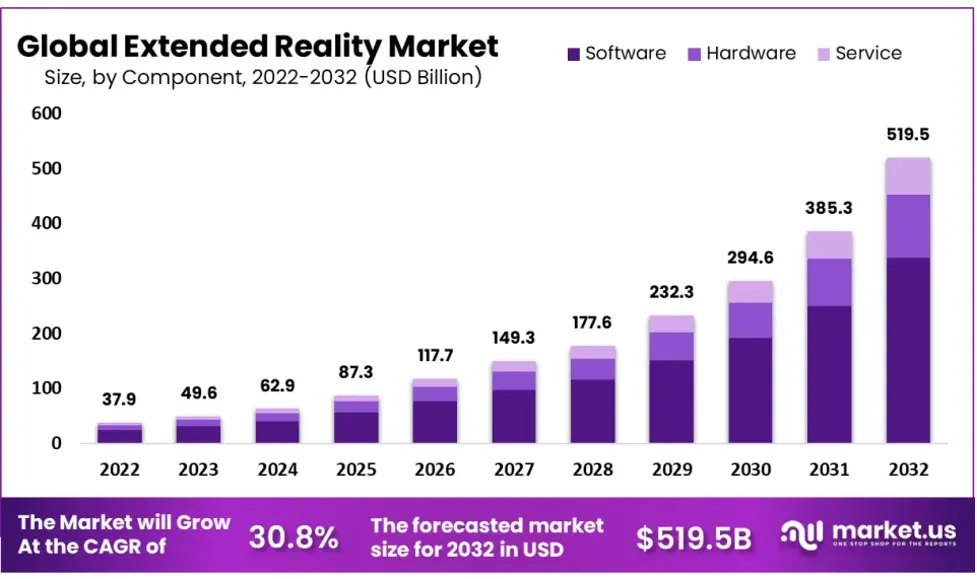

Global XR market projected to reach USD 532.7B by 2030 (CAGR 48.7%). VR Headsets: USD 13.9B in 2025. AR/MR Devices: Faster growth.

Key Competitors (Platforms – Early 2025): Meta (Quest/Horizon OS), Apple (VisionOS), Qualcomm (Snapdragon XR, partner to Google).

Equity Analyst/Strategist Perspective: Android XR & Future Valuation

Strategic Imperative:

Securing a dominant position in the next computing paradigm (XR) is crucial for Alphabet’s long-term relevance and intrinsic value growth beyond its current core businesses. Android XR with Gemini is a direct effort to capture this future market.

Upside Potential & Monetization:

Massive potential for new hardware sales, app store revenue (akin to mobile), advertising within immersive environments, and new forms of digital commerce. Establishing an early lead could generate significant value that is not yet factored into GOOGL’s stock price.

Risks & Competitive Dynamics:

High R&D costs, slow consumer adoption rates (chicken-and-egg problem with content), intense competition (Apple, Meta), the need for robust hardware partnerships (dependent on Samsung), and regulatory uncertainties in new digital spaces pose significant risks to this long-term play.

Key Performance Indicators (KPIs) for Investors (Valuation Context):

Monitor Android XR device shipments, developer engagement for the platform, content ecosystem growth, and early indications of consumer adoption and monetization models. These are speculative but vital for tracking the “call option” value embedded in Alphabet’s forward strategy.

Overall Valuation Conclusion: GOOGL – Strategically Positioned for AI-Driven Intrinsic Value Growth

Our analysis indicates that Alphabet (GOOGL) is strategically positioned to capitalize on the AI revolution. While market competition and execution risks persist, the breadth and depth of AI innovation presented at Google I/O 2025—especially with Gemini 2.5 and AI Mode in Search—strengthen the argument for continued revenue growth, margin expansion, and a reinforced competitive moat. The long-term bets on Agentic AI and Android XR provide substantial optionality, suggesting that Alphabet’s current valuation may not fully reflect its intrinsic value potential in an AI-first world.

Ready for deeper insights into equity valuations?

Free Alert when Top value investor buy

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investors should conduct their own due diligence.