Value Fund Alert: Synsam Group

Top Value Investor Signals Confidence in SYNSAM

Dear Valued Investor,

Remember Elopak? The stock we flagged last month after William Higgons’ fund bought in is already up +8.08%. We’re now flagging that Higgons has purchased another Scandinavian company: Synsam Group AB (STO: SYNSAM). Below, we dive into the facts of the business for your own analysis.

Company: Synsam Group AB (STO: SYNSAM)

Fund Manager: William Higgons (Indépendance AM)

Action: Buy

Stock Price: SEK 53.40

Forward P/E: ~14.1x

Dividend Yield: ~3.2%

Not financial advice. Do your own research.

Indépendance AM’s Investment Philosophy

William Higgons at Indépendance AM follows a Growth at a Reasonable Price (GARP) strategy, targeting companies with solid growth at attractive valuations. Their long-term, ESG-integrated approach, backed by rigorous research and management engagement, has driven strong returns: +13.1% annualized performance since 1993.

Company Overview

Synsam Group is the Nordic region’s leading optical retailer, operating ~600 stores, an e-commerce platform, and a subscription model. Its Synsam Lifestyle subscription, with 850,000+ customers, generates SEK 3B (~$288M USD) in recurring revenue annually. Synsam’s in-house production in Sweden enhances margins and sustainability.

- ~600 stores across Nordic high-traffic locations

- 850,000+ subscribers for stable cash flows

- Vertical integration with in-house production

- Omnichannel growth via retail, outlets, and e-commerce

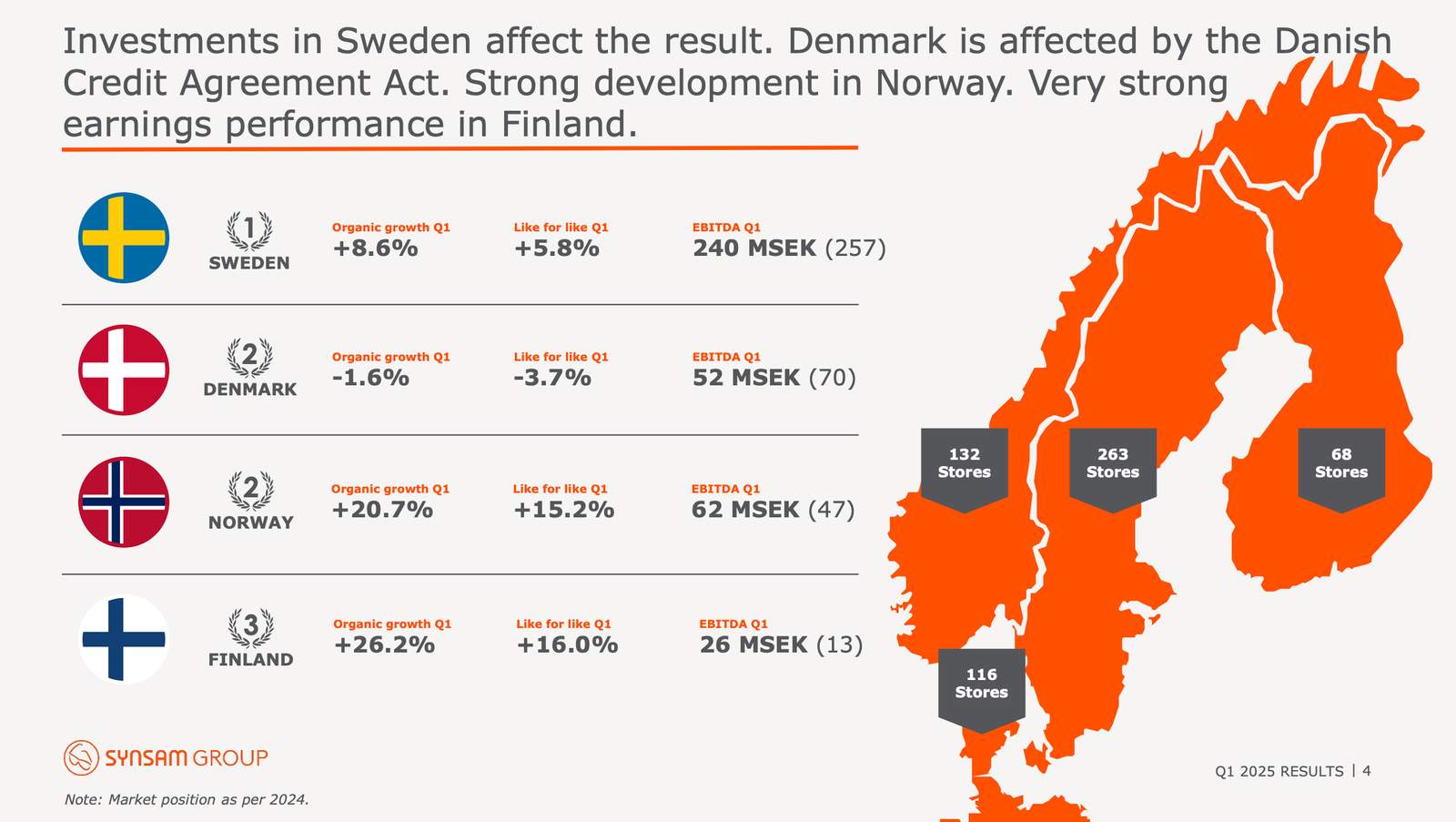

Synsam Q1 2025 Result (Source: Company Presentation)

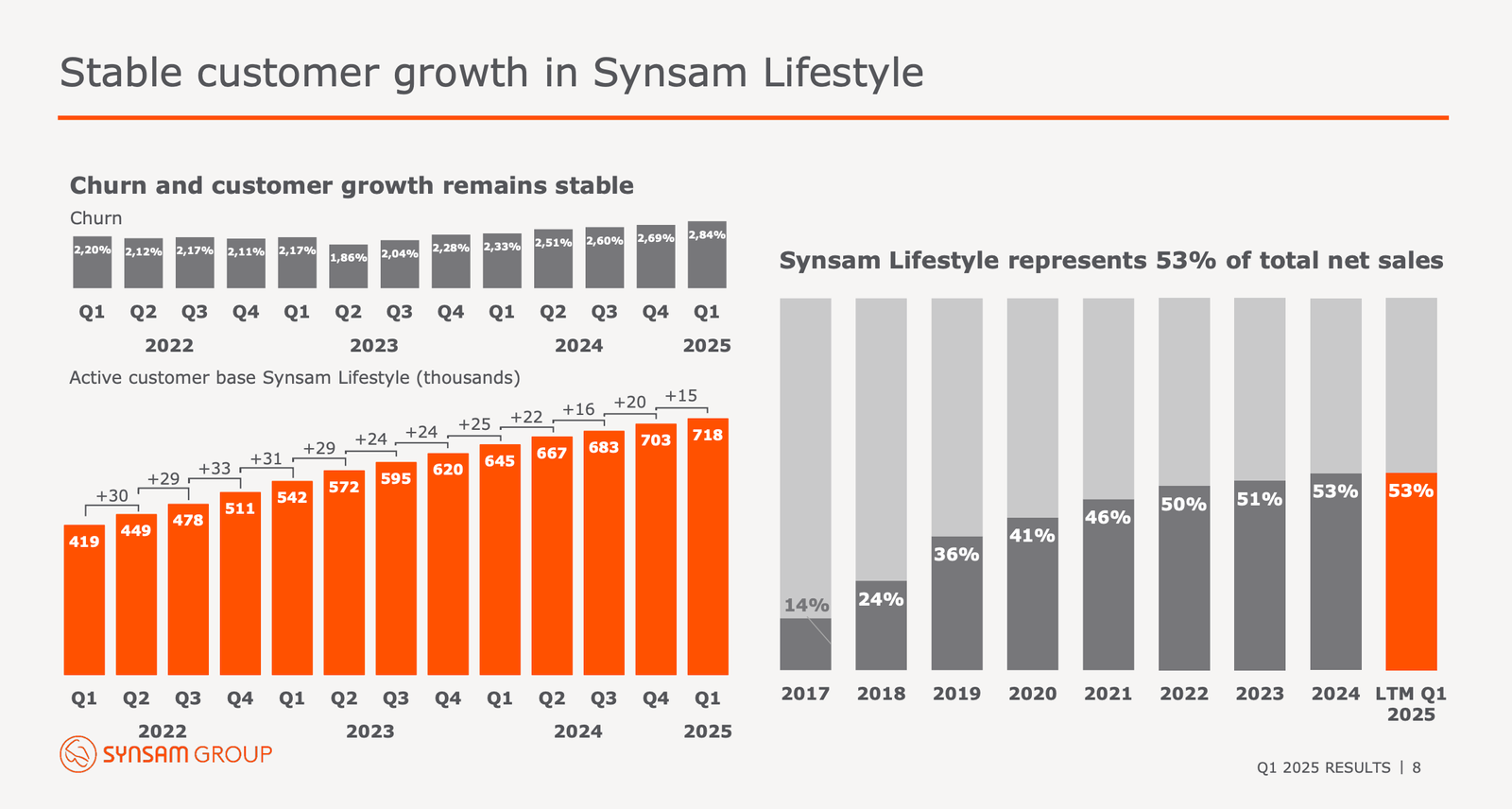

Synsam Q1 2025 Growth and Churn (Source: Company Presentation)

Fund Sentiment

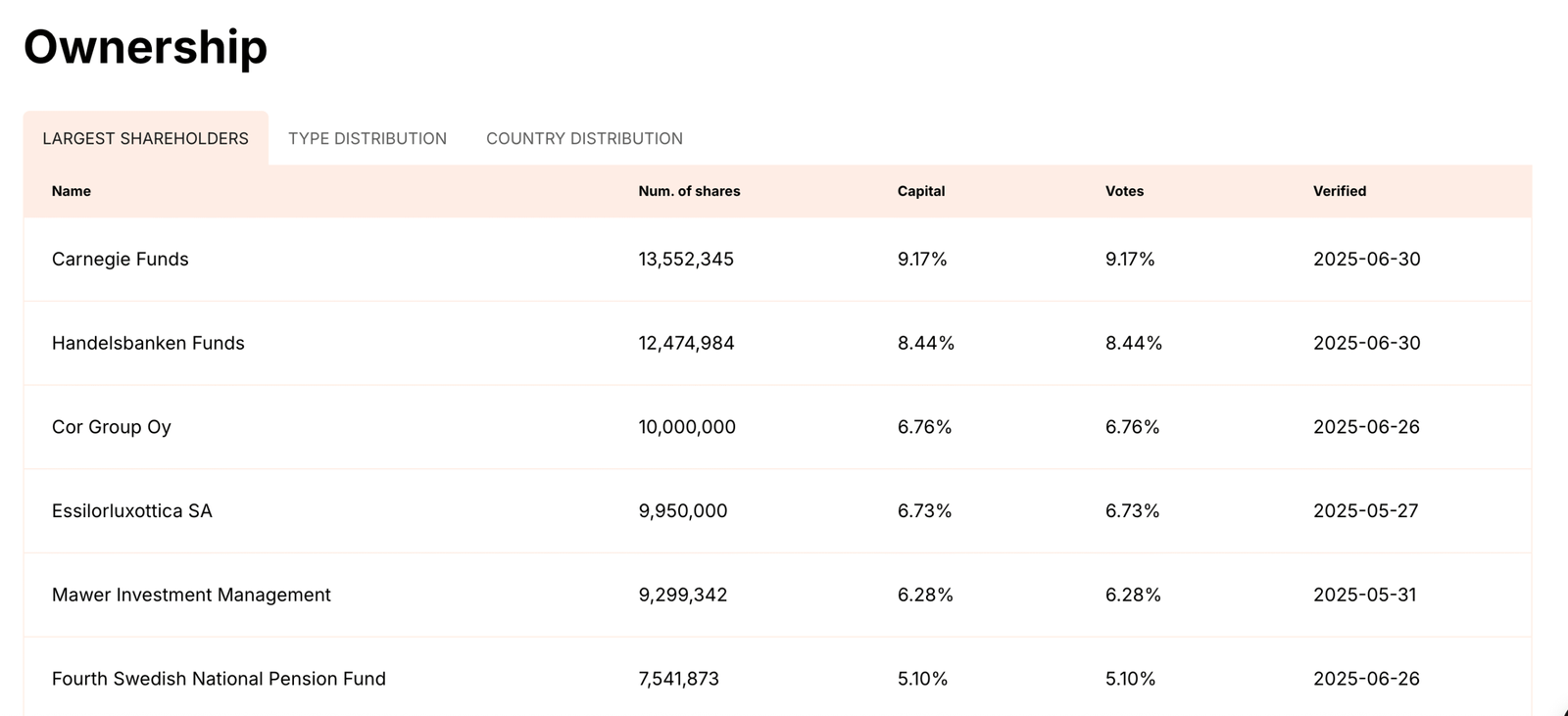

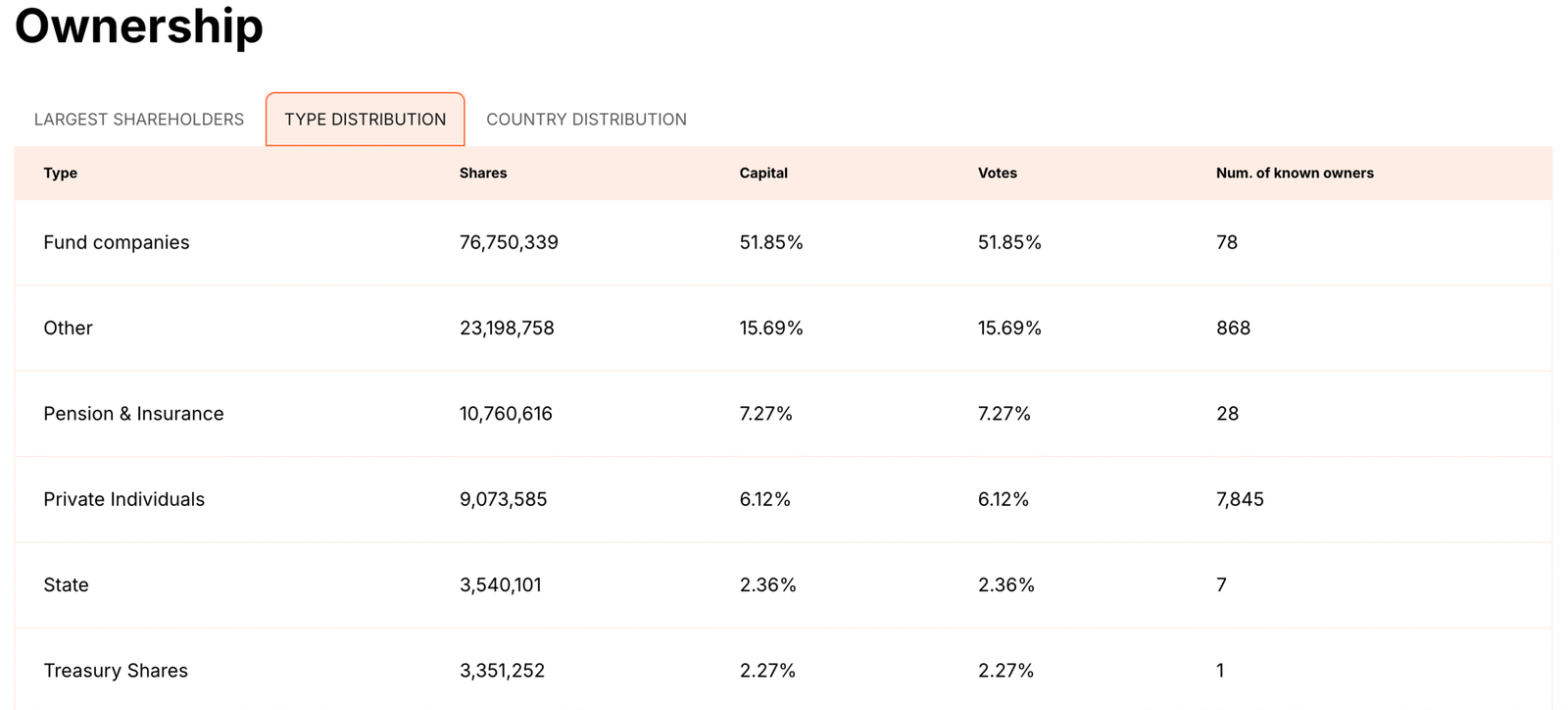

Fund Ownership in SYNSAM (Source: company report)

Type of fund Ownership in SYNSAM stock (Source: company)

Why SYNSAM Stands Out

Synsam’s 2024 and Q1 2025 performance demonstrates robust growth, with 9.2% organic growth in 2024 and 10.3% in Q1 2025, alongside an 11.6% operating margin. Key drivers include:

- Subscription Model: 850,000+ subscribers ensure predictable revenue.

- Store Expansion: 46 new stores in 2024, reaching ~600 total.

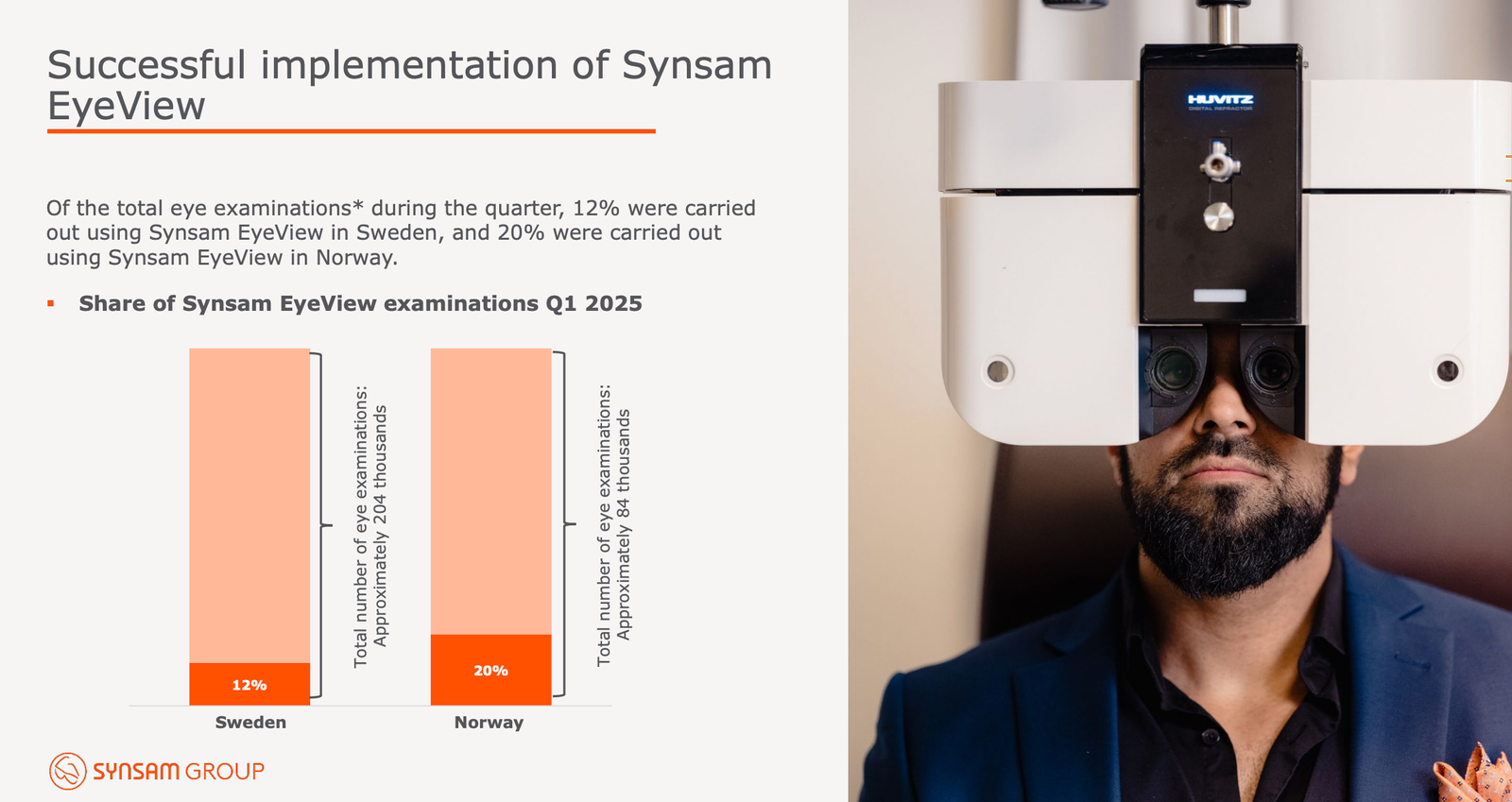

- Technology: Synsam EyeView enhances optician capacity.

The Synsam Lifestyle subscription model enables customers to pay a monthly fee starting at SEK 98 for regular eyewear updates, including annual eye exams, new glasses every 12–24 months, and insurance, ensuring predictable revenue with 858,000 subscribers generating SEK 3B annually as of Q1 2025. Its power lies in high customer loyalty (2.84% quarterly churn, 12.5% sales growth) and non-cyclical demand, bolstered by 600+ Nordic stores and omnichannel integration, including e-commerce for contact lenses and sunglasses.

Synsam Q1 2025 Highlights (Source: Company Presentation)

Valuation Snapshot

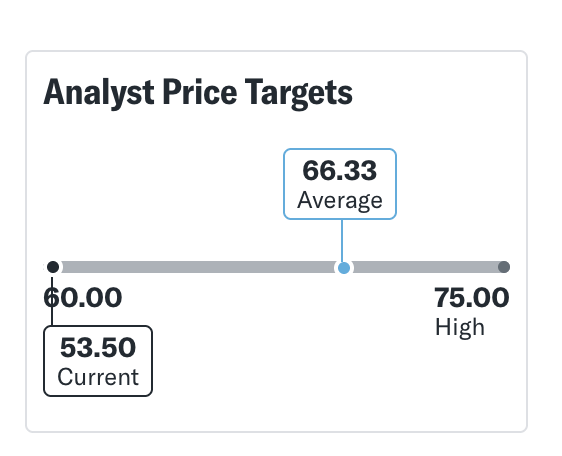

Forward P/E reflects growth potential; trailing P/E is 25% below 5-year average. Data as of July 2025.

Margin of Safety

Synsam offers a compelling margin of safety for value investors, combining operational stability and attractive valuation:

- Operational Stability: Non-cyclical eyewear demand and 850,000+ subscribers ensure steady cash flows.

- Fair Valuation: Forward P/E of ~14.1x, 25% below 5-year average, with ~15% upside (Nordea SEK 195, July 2025).

- Stable Cash Flows: 3.2% dividend yield and share buybacks reward investors.

- Low Financial Risk: Debt-to-equity ratio of 0.45x is below industry average.

- Institutional Confidence: Fund holdings up 4.2% in Q1 2025.

Data from Bloomberg, Synsam Q1 2025 Report, analyst estimates (July 2025).

Competitive Landscape

Synsam dominates the Nordic eyewear market but faces competition from European players.

| Company | Key Strength | Relative Threat |

|---|---|---|

| Synsam Group | Subscription model, Nordic dominance | Our focus |

| Fielmann AG | Strong European retail network | ⭐⭐⭐⭐ |

| Mister Spex SE | E-commerce focus | ⭐⭐ |

| GrandVision | Global retail presence | ⭐⭐⭐ |

Competitive Ratio Analysis

| Company | Revenue (SEK B) | Operating Margin % | Forward P/E (x) | Debt-to-Equity | Div. Yield (%) |

|---|---|---|---|---|---|

| Synsam Group | 1.4 | 11.6 | 14.1 | 0.45 | 3.2 |

| Fielmann AG | 3.2 | 8.5 | 25.6 | 0.32 | 2.3 |

| Mister Spex SE | 0.6 | -5.2 | N/A | 0.15 | 0.0 |

| GrandVision | 4.1 | 7.8 | 22.3 | 0.50 | 1.9 |

Revenue reflects Q1 2025; other metrics as of July 2025. Data from Bloomberg, company reports.

Geographical Diversification

Synsam dominates the Nordic region, with a 70% market share in Sweden and strong positions in Denmark, Norway, and Finland. In Q1 2025, revenue grew 8.5% in Norway and Denmark, driven by new store openings and e-commerce expansion. The company targets 8-12% organic growth regionally.

Analyst Consensus

Analyst Ratings for SYNSAM (Source: Bloomberg)

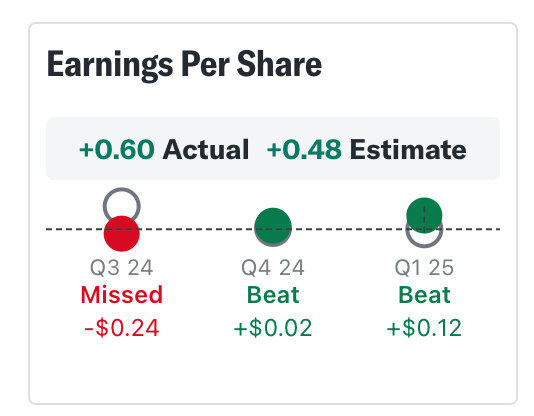

SYNSAM Earnings

Earnings per Share (Source: Bloomberg)

Key Takeaways

- Financial Growth: 2024 net sales rose 9.0% to SEK 6,435M; Q1 2025 organic growth was 10.3% with an 11.6% operating margin.

- Strategic Edge: 850,000+ subscribers and ~600 stores drive stable revenue and market dominance.

- Regional Strength: 70% market share in Sweden, with 8.5% growth in Norway and Denmark in Q1 2025.

- Margin of Safety: Non-cyclical demand and forward P/E of ~14.1x offer stability and ~15% upside.