Uranium: The Next Gold Rush in a Warming, Digitizing World

Expert Insights: Uranium’s Investment Case

- Uranium’s Value Is Skyrocketing Global demand for clean energy is surging. Nuclear power relies on uranium, driving its price higher. This creates big opportunities for investors.

- Not Enough Uranium to Go Around The world needs 195 million pounds of uranium yearly. Mines produce only 109 million pounds. This shortage means higher prices and profits.

- Nuclear Power Is Booming Countries are building new nuclear plants fast. Over 70 gigawatts of projects are underway. Uranium demand will keep growing, boosting investments.

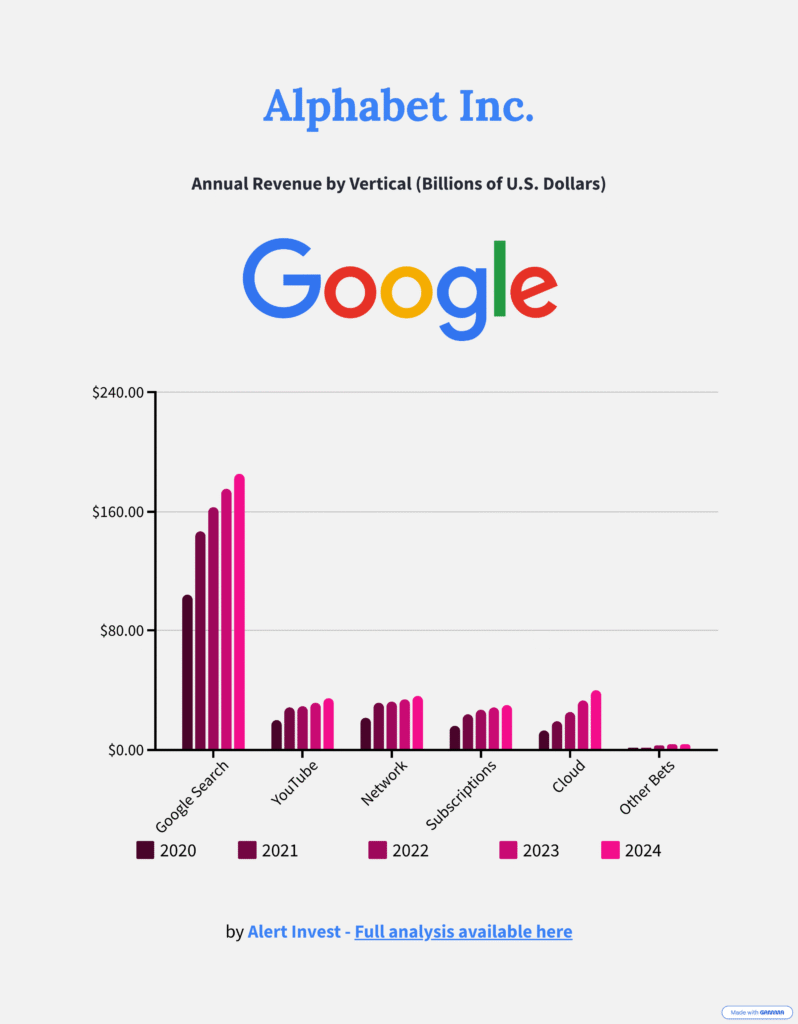

- AI Needs Uranium’s Power AI data centers use massive electricity. Nuclear power is a top solution. Investing in uranium taps into this tech-driven demand. US-based nuclear development company Elementl Power has formed a strategic partnership with Google to pre-position three US sites for advanced nuclear energy development. Google is committing early-stage development capital to the projects. Other tech companies Amazon, Microsoft and Facebook owner Meta have all signed agreements in recent months which could lead to them utilising nuclear technology to provide power for their growing data centre needs. The advantage of nuclear power is seen to be the ability to have 24/7 reliable, and clean, energy.

- Smart Picks in Uranium Stocks Some uranium companies are undervalued. Their strong operations promise big returns. Investors can profit as uranium prices rise.

The global energy landscape is transforming, driven by decarbonization, energy security, and AI’s power demands. Nuclear power is regaining prominence, positioning uranium as a critical commodity for a potential “Uranium Rush” rooted in enduring global imperatives.

The Nuclear Renaissance Takes Hold

Over 70 gigawatts of nuclear capacity are under construction globally, a 30-year high. Nations like China are leading, set to surpass the U.S. and Europe by 2030.

- Decarbonization: Nuclear offers reliable, low-carbon baseload power for net-zero goals.

- Energy Security: Geopolitical instability drives diversification with nuclear’s stable fuel contracts.

- SMRs: Small Modular Reactors promise scalability, safety, and new market opportunities.

AI and Data Centers: A New Demand Driver

Data center electricity use is projected to double by 2030, with AI-optimized centers quadrupling demand. Tech giants like Amazon and Google are exploring nuclear, including SMRs, to meet this need, creating a long-term tailwind for uranium. Google has signed a “world first” deal to buy energy from a fleet of mini nuclear reactors to generate the power needed for the rise in use of artificial intelligence.

Equity Analyst’s Perspective: Identifying Value

The uranium sector offers compelling opportunities due to a widening supply deficit and inelastic demand. A rigorous framework highlights these top uranium stocks:

Cameco Corporation

NYSE: CCJ (Yahoo) NYSE: CCJ (Google)Investment Thesis: The world’s largest public uranium producer, with low-cost assets in Canada and Westinghouse acquisition for nuclear fuel cycle exposure.

Value Proposition: Foundational holding with stability and leverage to rising uranium prices.

NAC Kazatomprom JSC

LSE: KAP (Yahoo) LSE: KAP (Google)Investment Thesis: Kazakhstan’s low-cost leader with ISR mining, offering high margins and exposure to global supply.

Value Proposition: Resilient across market conditions, though state ownership adds geopolitical risk.

Uranium Energy Corp

NYSE: UEC (Yahoo) NYSE: UEC (Google)Investment Thesis: U.S.-based with ISR projects and uranium inventory, poised for domestic nuclear growth.

Value Proposition: High-beta play on U.S. nuclear policy and production incentives.

Paladin Energy

ASX: PDN (Yahoo) ASX: PDN (Google)Investment Thesis: Restarting Namibia’s Langer Heinrich mine adds crucial supply to a tight market.

Value Proposition: High-impact play for institutional buyers seeking diversified uranium exposure.

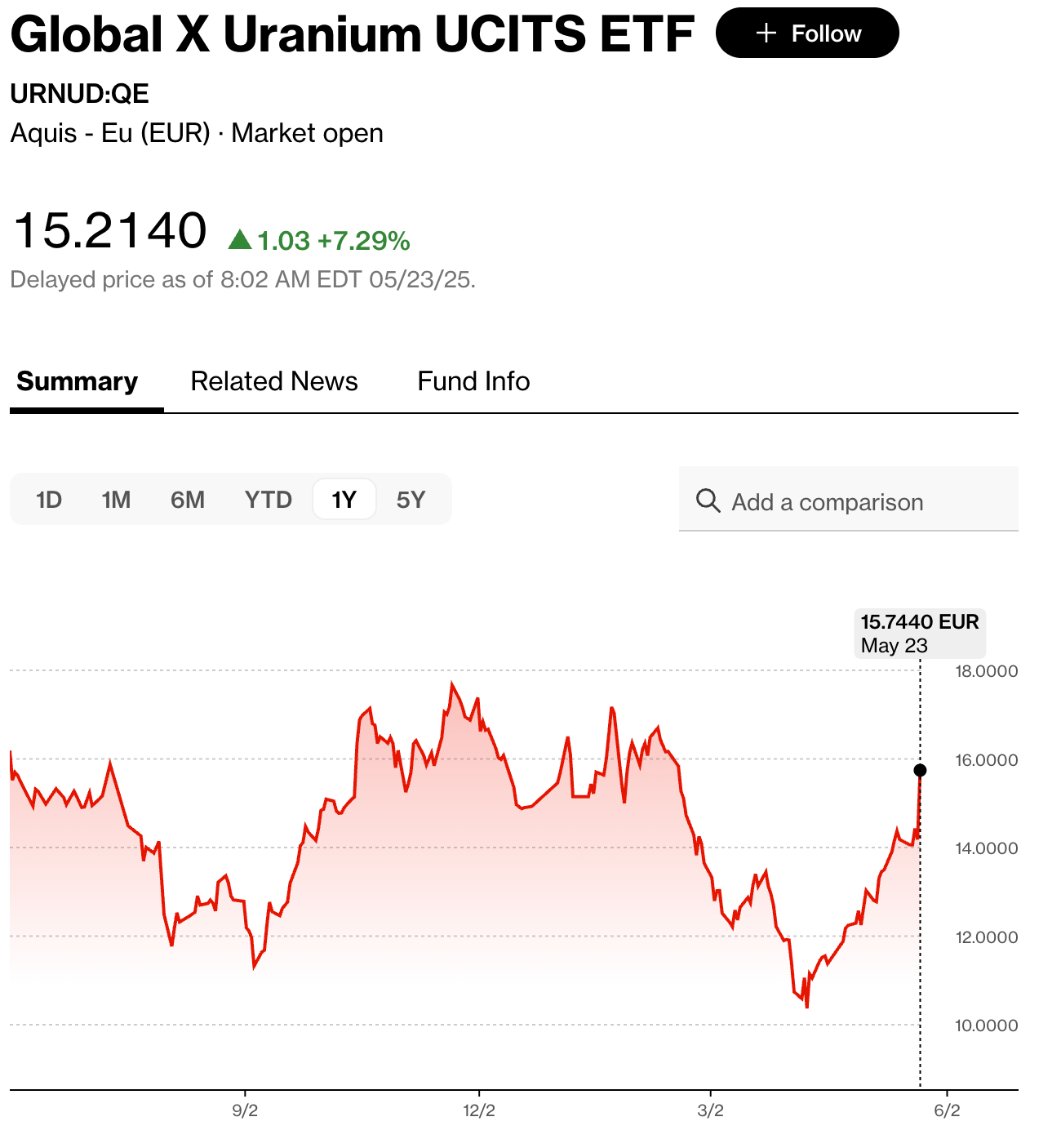

Uranium ETF Performance

Concluding Insight

The uranium sector’s structural re-rating, driven by decarbonization, energy security, and AI, offers a unique opportunity for value investors. Position now for the “Uranium Rush.”

Free Alert when top value investor buy a stock