Value Fund Alert: De’Longhi S.p.A.

Top Value Investor Signals Confidence in De’Longhi (BIT: DLG)

Dear Valued Investor,

Remember my last alert on Synsam after William Higgons took a position? Well, it’s already up a nice +7.5%! While short-term gains are fun, my real focus is always on long-term value. For context, the portfolio I’m tracking is up an impressive +23.32% this year.

I’ve been tracking Higgons, but the real highlight for me is seeing Thomas Russo get involved. He’s known for picking solid companies at fair prices—a skill he learned directly from Warren Buffett. When two top investors like this team up on one stock, it’s worth paying attention to. It takes me hours of analysis (and a lot of espresso from my trusty De’Longhi machine) to keep up with these moves!

Speaking of De’Longhi, it’s also a company Higgons and Russo are buying at fair prices—a perfect example of Higgons’ recent pick that caught my eye. Let’s dive into my breakdown of this investment case, a follow-up on a company showing some serious financial muscle.

Company: De’Longhi S.p.A. (BIT: DLG)

Fund Manager: William Higgons (Indépendance AM) + Thomas Russo – Gardner Russo & Quinn

Action: Buy

Stock Price: €29.46

Forward P/E: ~13x

Dividend Yield: ~4.3%

Not financial advice. Do your own research.

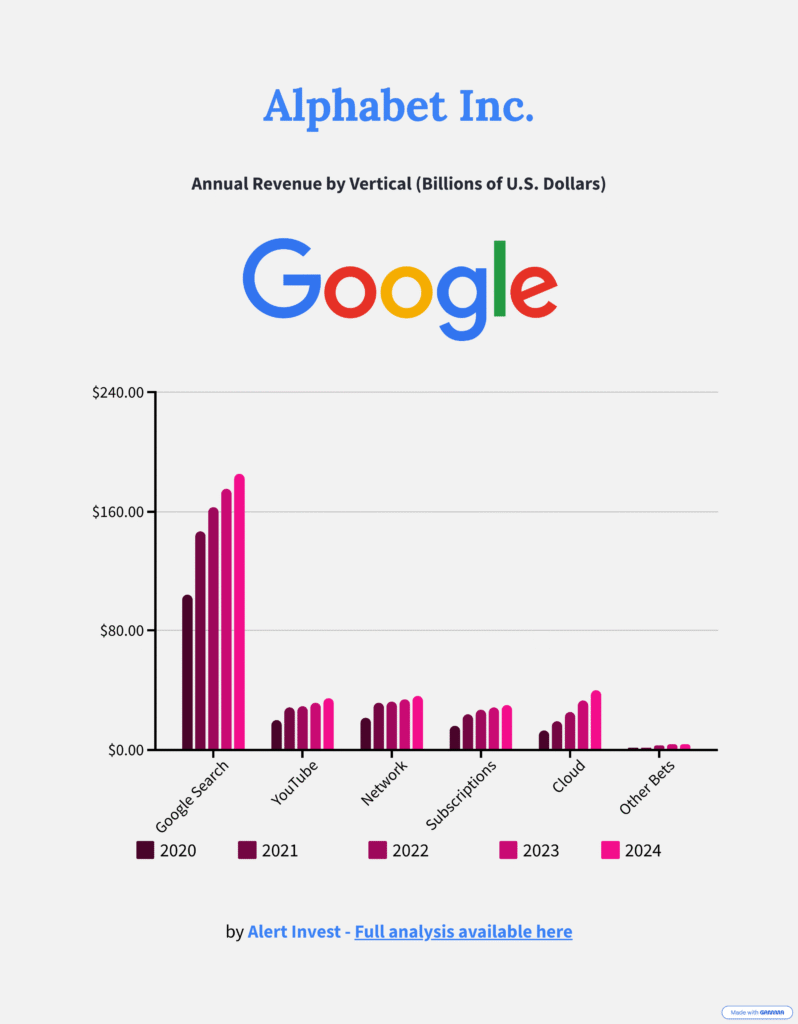

Company Overview

De’Longhi S.p.A. is a global leader in household appliances, specializing in coffee machines, kitchen appliances, and professional equipment. With a presence in over 100 countries and iconic brands like De’Longhi, Braun, and Kenwood, the company commands a strong market position. Its vertically integrated supply chain and focus on premium products drive consistent margins and brand loyalty.

- Global Reach: Operations in 100+ countries with ~30% market share in espresso machines.

- Brand Portfolio: Premium brands like De’Longhi and Braun ensure pricing power.

- Innovation: Investments in R&D for smart appliances and sustainability.

- Financial Discipline: Low debt and consistent cash flow generation.

De’Longhi Company Overview (Source: Company Presentation)

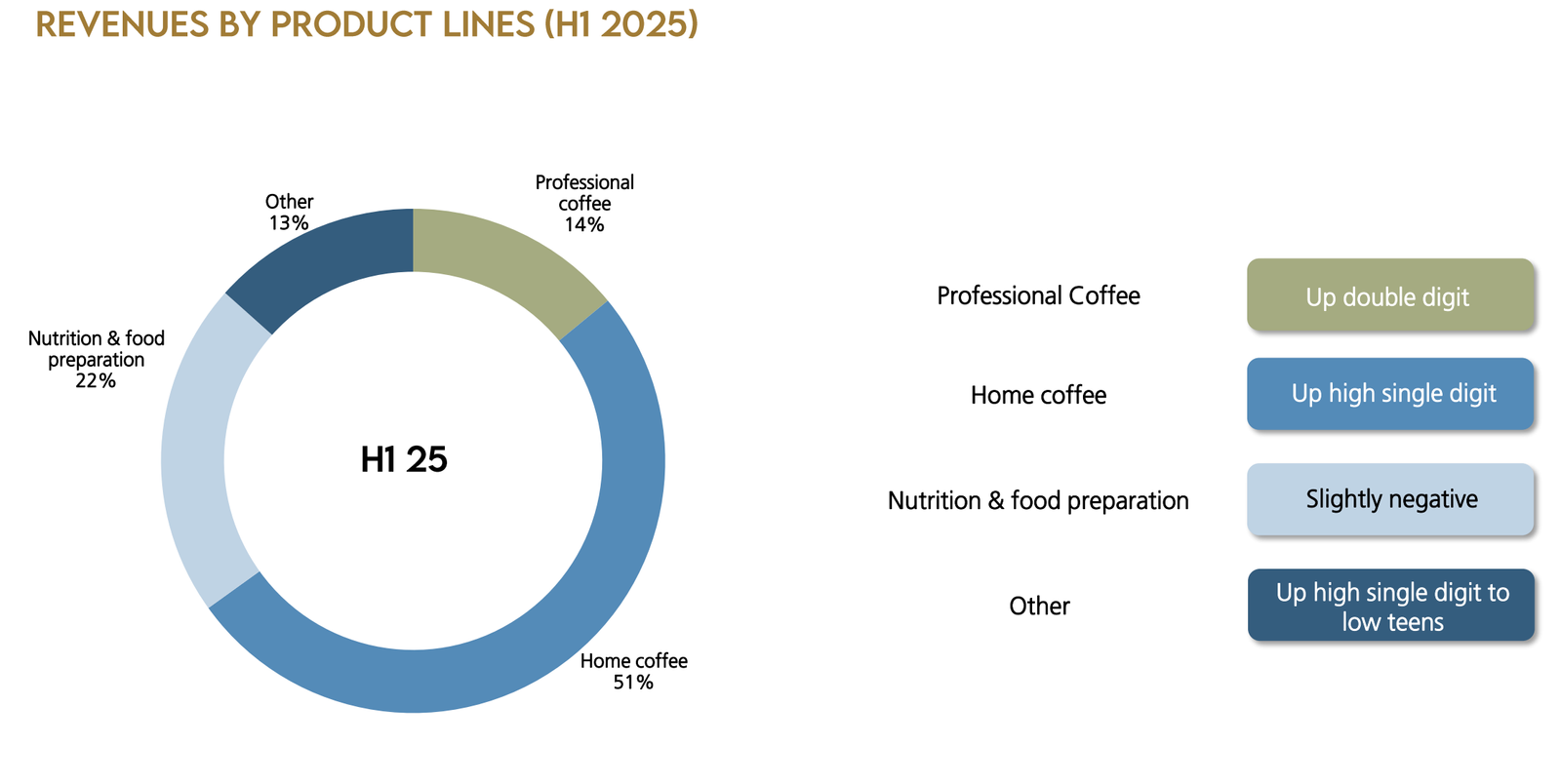

Recent Acquisition: La Marzocco

In December 2023, De’Longhi acquired La Marzocco, a leading manufacturer of professional espresso machines. This strategic move strengthened De’Longhi’s position in the professional coffee segment, combining La Marzocco’s iconic brand with Eversys to drive over 20% growth in the professional division in H1 2025. The acquisition has enhanced synergies in product development and global distribution, contributing to robust revenue growth and margin expansion.

Key H1 2025 Financial Results

- Revenues: €1,584.2 million, an increase of 11.3% compared to H1 2024 (11.8% at constant FX).

- Adjusted EBITDA: €240.7 million, with the margin improving to 15.2% from 14.4%.

- Net Income: €116.6 million, up 9.8% from the previous year.

- Guidance: Upgraded full-year 2025 guidance to revenue growth of 6-8% and adjusted EBITDA of €590-610 million.

De’Longhi H1 2025 Financial Results (Source: Company Presentation)

Data from De’Longhi H1 2025 Report.

Fund Sentiment

Institutional ownership in De’Longhi has increased by 3.8% in H1 2025, reflecting growing confidence among value-focused funds. Indépendance AM’s stake, alongside other prominent European funds, underscores the stock’s appeal to long-term investors.

Why De’Longhi Stands Out

De’Longhi’s H1 2025 performance highlights its resilience and growth potential in a competitive sector. Key drivers include:

- Premium Brand Positioning: Leadership in high-margin categories like espresso machines.

- Operational Efficiency: Improved EBITDA margin to 15.2% in H1 2025.

- Global Expansion: Strong growth in Asia-Pacific and North America.

- Sustainability Focus: Investments in eco-friendly products align with consumer trends.

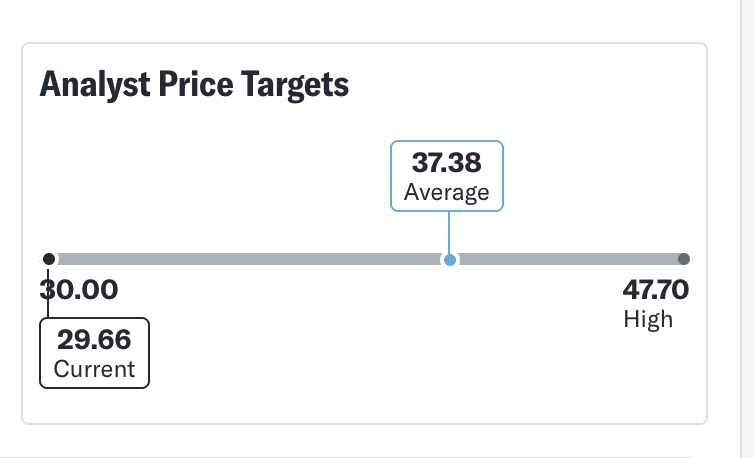

Valuation Snapshot

Forward P/E reflects growth potential; trailing P/E is 20% below 5-year average. Data as of September 2025.

Margin of Safety

De’Longhi offers a strong margin of safety for value investors, combining operational stability and attractive valuation:

- Operational Stability: Diversified portfolio and global presence reduce market-specific risks.

- Fair Valuation: Forward P/E of ~13x, 20% below 5-year average, with ~25.6% upside based on analyst targets of €37.

- Stable Cash Flows: 4.27% dividend yield and consistent free cash flow generation.

- Low Financial Risk: Debt-to-equity ratio of 31.32% is well below industry peers.

- Institutional Confidence: Fund holdings up 3.8% in H1 2025.

Data from Bloomberg, De’Longhi H1 2025 Report, analyst estimates (September 2025).

Competitive Landscape

De’Longhi competes in the global household appliance market, with a strong focus on premium categories.

| Company | Key Strength | Relative Threat |

|---|---|---|

| De’Longhi | Premium brand, coffee machine dominance | Our focus |

| Groupe SEB | Broad small appliance portfolio | ⭐⭐⭐⭐ |

| Breville Group | Premium kitchen appliances | ⭐⭐ |

Competitive Ratio Analysis

| Company | Revenue (€M) | Operating Margin % | Forward P/E (x) | Debt-to-Equity | Div. Yield (%) |

|---|---|---|---|---|---|

| De’Longhi | 1,584.2 | 15.2 | 13 | 31.32 | 4.27 |

| Groupe SEB | 4,200.0 | 9.8 | 34.14 | 106.42 | 4.48 |

| Breville Group | 900.0 | 12.3 | 22.5 | 25.8 | 1.8 |

Revenue reflects H1 2025; other metrics as of September 2025. Data from Bloomberg, company reports.

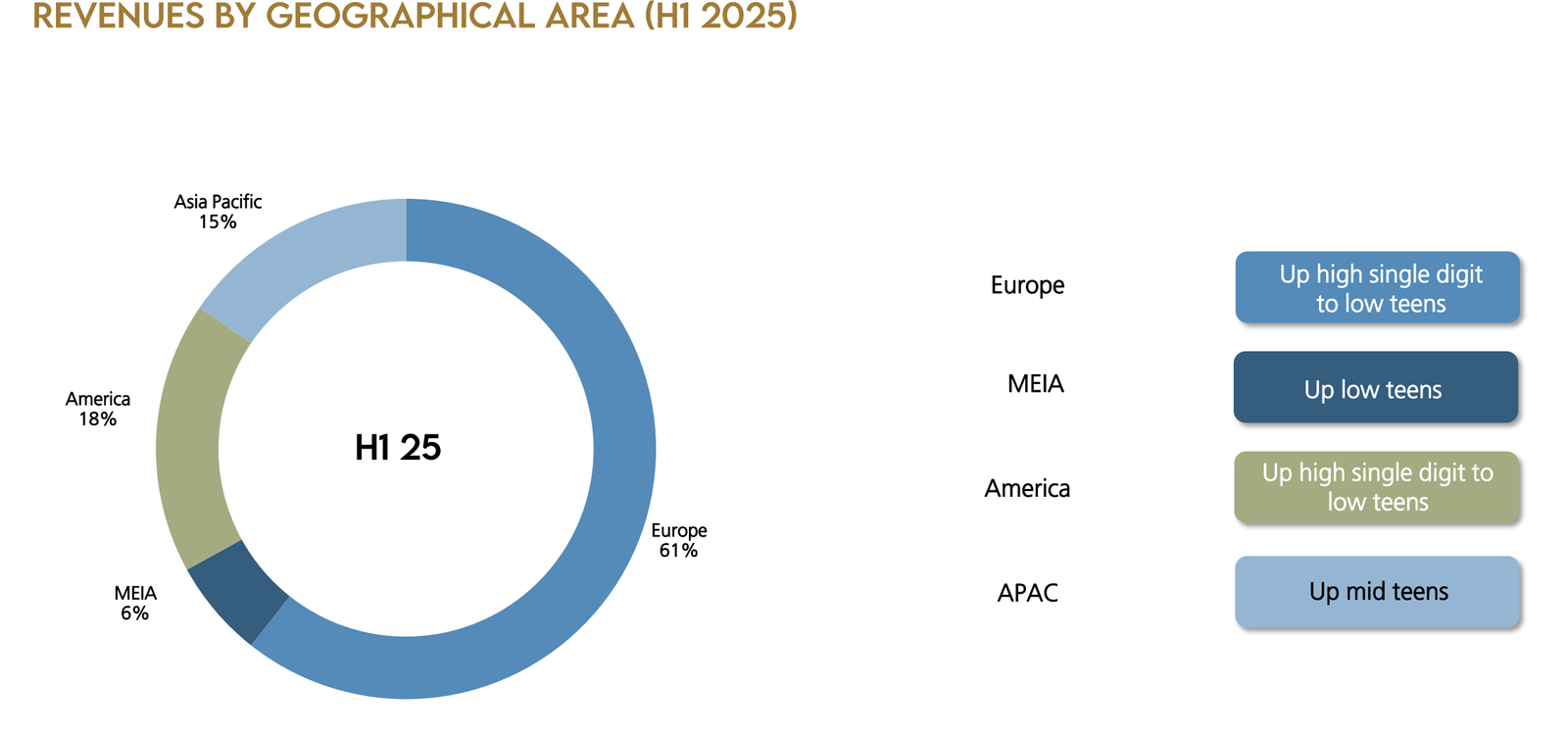

Geographical Diversification

De’Longhi generates ~61% of its revenue from Europe, with significant growth in Asia-Pacific (15% YoY) and North America (10% YoY) in H1 2025. Its diversified revenue streams and strong brand presence in emerging markets provide resilience against regional economic fluctuations.

De’Longhi Geographical Diversification (Source: Company Presentation)

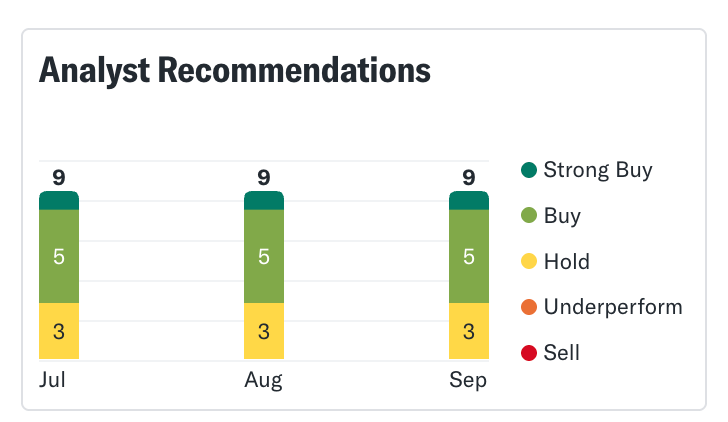

Analyst Consensus

Analyst sentiment for De’Longhi is positive, with a consensus price target of €37 indicating ~25.6% upside potential from the current stock price of €29.46. The majority of analysts rate the stock as a Buy, citing its strong fundamentals and growth prospects in key markets.

Analyst Ratings for De’Longhi (Source: Bloomberg)

Additional Analyst Consensus for De’Longhi (Source: Bloomberg)

Data from Bloomberg, analyst estimates (September 2025).

Key Takeaways

- Financial Growth: H1 2025 revenues up 11.3% to €1,584.2M with a 15.2% EBITDA margin.

- Strategic Edge: Premium brand portfolio and global presence ensure pricing power.

- Regional Strength: Strong growth in Asia-Pacific (15%) and North America (10%).

- Margin of Safety: Low debt-to-equity (31.32%) and forward P/E of ~13x offer ~25.6% upside.