Value Fund Alert: Why Top Investors Are Buying Visa (V)

When one top value investor buys a stock, it’s worth noting. When several do, it’s a powerful signal that demands attention. Recently, respected fund managers like Chris Hohn, David Katz, and Francois Rochon have all significantly increased their positions in Visa Inc. (NYSE: V). Below, we dive into the data to see why they might be choosing Visa over its main rival, Mastercard.

A New Home for Our Community

I’ve got some personal news I’m really excited to share. I’m building a new online home for all my content to make it easier for us to connect—everything from market updates to portfolio guides will be in one spot. Become a free member to get more stock update and insights!

Discover the PlatformCompany: Visa Inc. (NYSE: V)

Fund Manager: Chris Hohn (TCI), David Katz (Matrix), Francois Rochon (Giverny)

Action: Buy

Stock Price: $340.30

Forward P/E: ~27.3x

Dividend Yield: ~0.7%

Company Overview

Visa is a global leader in digital payments, operating the world’s largest retail electronic payments network. It provides the essential infrastructure for transactions between consumers, merchants, and financial institutions across more than 200 countries. Visa’s business model is incredibly asset-light, generating fees from payment volumes and transactions processed on its secure VisaNet system.

Why Visa Stands Out

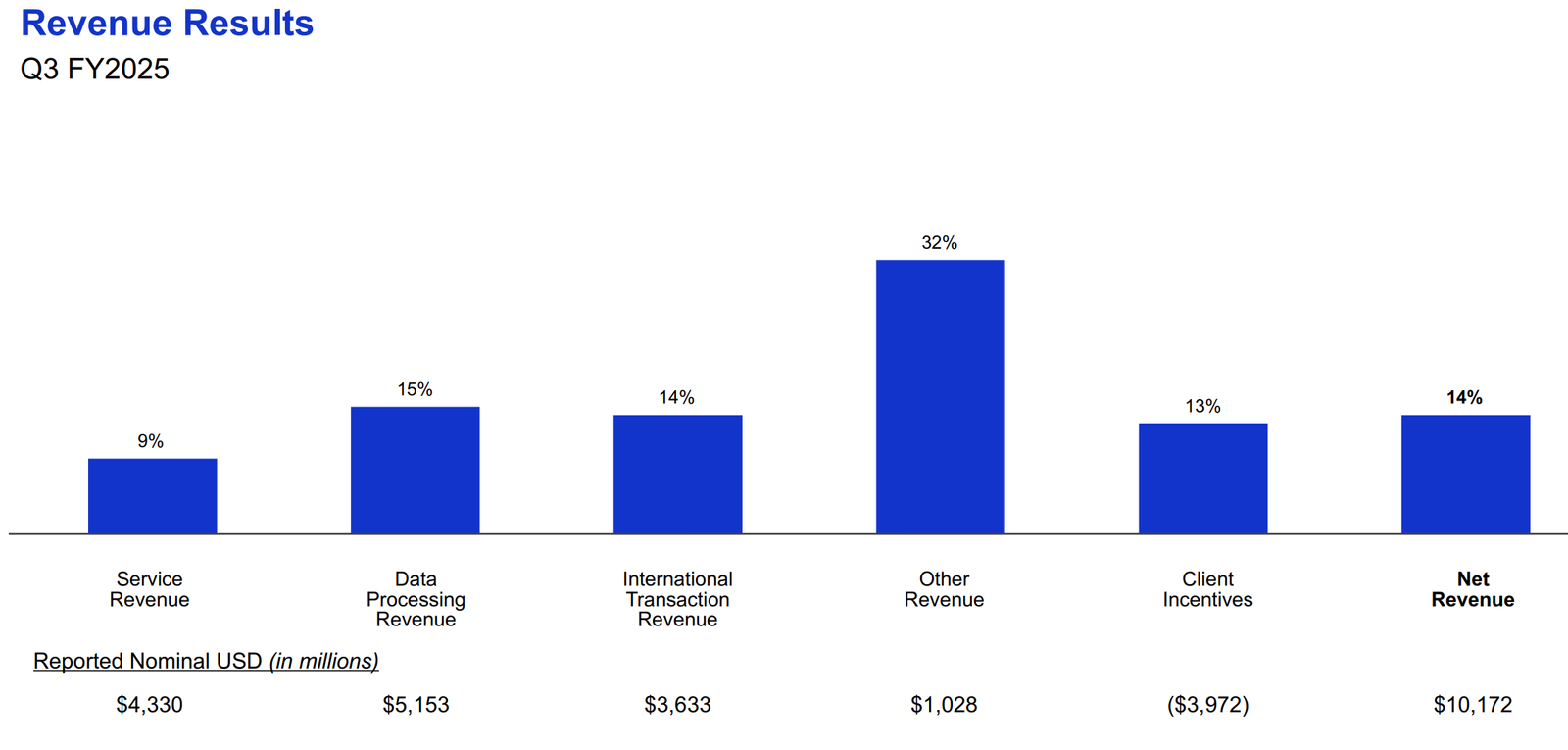

Visa’s financial performance is a testament to its dominant market position and scalable business model. It boasts best-in-class 67.0% operating margins and a stable, high Return on Invested Capital of 23.8% (5-year average). Key drivers include:

- The Network Effect: An impenetrable moat where more cardholders attract more merchants, and vice versa, creating a self-reinforcing cycle.

- Consistent Growth: Visa has maintained a steady 11.2% 5-year revenue growth rate, demonstrating durable, long-term performance.

- Shareholder Returns: A strong commitment to returning capital, evidenced by a 14.5% 5-year dividend growth rate.

Performance Ratio Analysis

| Company | Operating Margin % | FCF Margin % | ROIC (5Yr Avg) % |

|---|---|---|---|

| Visa Inc. (V) | 67.0% | 56.8% | 23.8% |

| Mastercard (MA) | 58.7% | 54.7% | 39.8% |

Valuation Analysis

| Company | P/E (TTM) | EV / Sales (TTM) | P/FCF (TTM) |

|---|---|---|---|

| Visa Inc. (V) | 33.1x | 17.0x | 29.7x |

| Mastercard (MA) | 39.3x | 17.8x | 32.0x |

Growth at a Reasonable Price (GARP)

| Company | Forward P/E (NTM) | 3-Yr Rev Growth (CAGR) |

|---|---|---|

| Visa Inc. (V) | 27.3x | 11.5% |

| Mastercard (MA) | 33.1x | 13.2% |

Margin of Safety

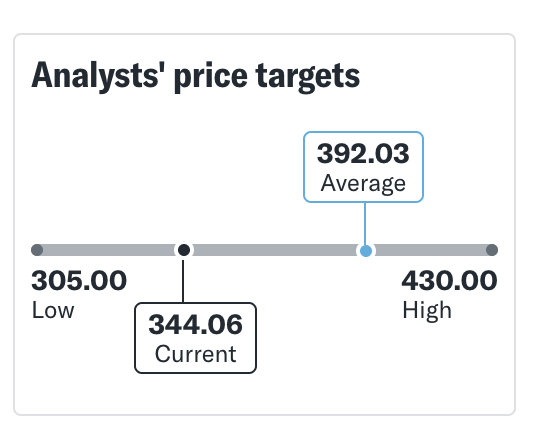

Visa does not trade at a statistically cheap price, so a traditional margin of safety is not apparent. However, for a super-quality business like Visa, the margin of safety comes from the durability and predictability of its earnings power. Its impenetrable network moat, capital-light business model, and secular tailwinds from digital payments provide a powerful defense against permanent capital loss, which is the true risk investors face. Buying a wonderful business at a fair price can often be safer than buying a fair business at a cheap price.

The Verdict: Why Investors Favor Visa

This GARP analysis adds nuance to our verdict. Mastercard justifies its premium valuation with slightly higher historical revenue growth (13.2% vs. 11.5%). However, Visa still presents the more compelling overall case for value investors. It is substantially cheaper, with a Forward P/E of 27.3x compared to Mastercard’s 33.1x. This valuation gap is wider than the growth gap. Furthermore, Visa remains the more profitable operator with superior margins and a much stronger balance sheet (0.7 D/E vs. 2.4). For an investor who wants growth but is unwilling to overpay for it, Visa offers the better balance of growth, profitability, and price.

Frequently Asked Questions (FAQ)

Is Visa or Mastercard more profitable?

Visa is more profitable, with a higher operating margin of 67.0% compared to Mastercard’s 58.7%.

Which stock is cheaper, Visa or Mastercard?

Visa is the cheaper stock, trading at a lower P/E ratio (33.1x vs. 39.3x) and a lower P/FCF ratio (29.7x vs. 32.0x).

Which company has a stronger balance sheet?

Visa has a stronger, less leveraged balance sheet, with a Debt-to-Equity ratio of 0.7 compared to Mastercard’s 2.4.

A New Home for Our Community

I’ve got some personal news I’m really excited to share. I’m building a new online home for all my content to make it easier for us to connect—everything from market updates to portfolio guides will be in one spot. Become a free member to get more stock update and insights!

Discover the Platform