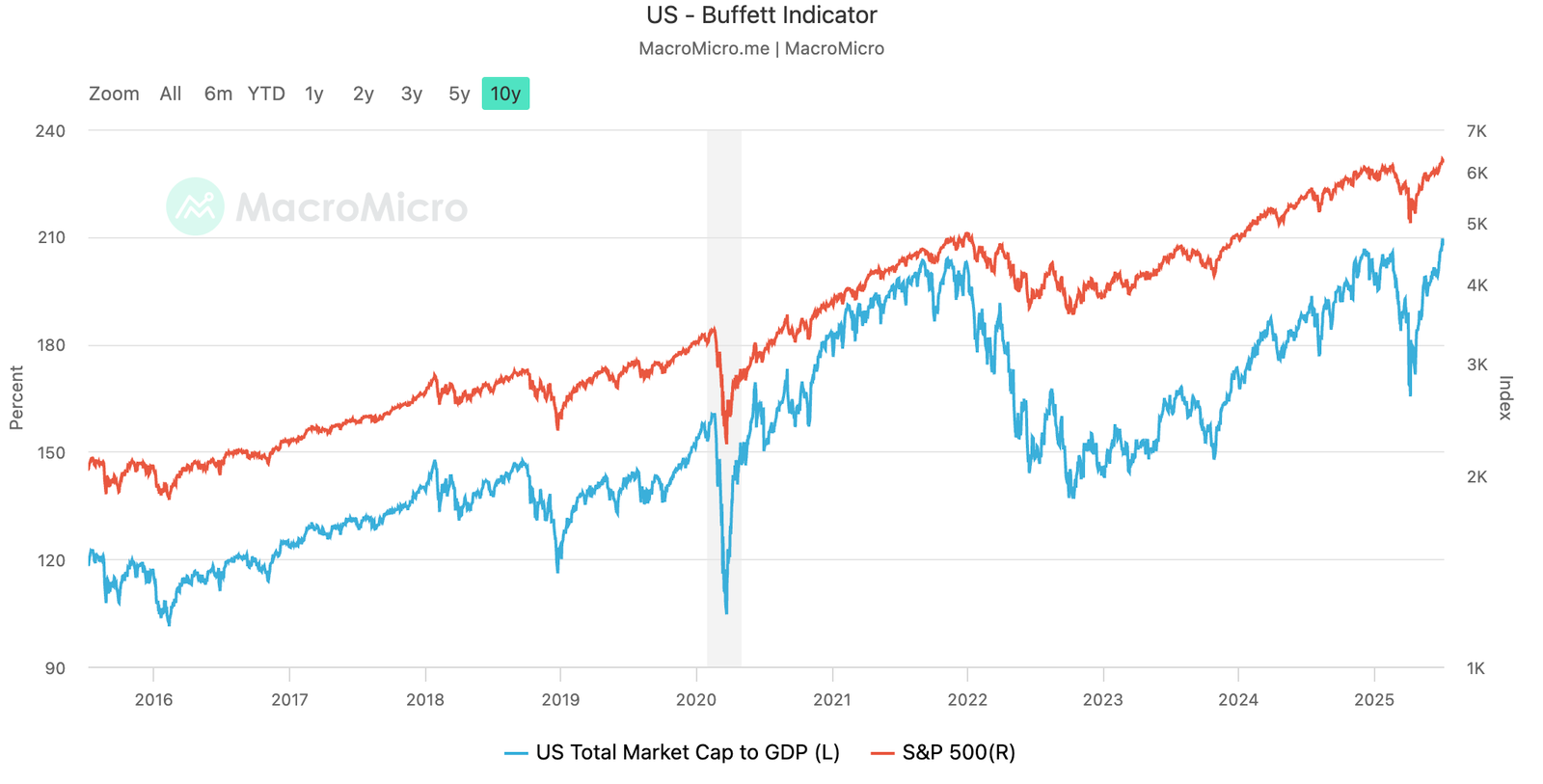

Buffett’s Favorite Indicator Hits 208%. It’s Time to Get Back to Real Investing.

Markets are booming. AI mania is fueling massive valuations. Indexes keep climbing. And yet—underneath it all—one of the most respected valuation signals in investing just hit a historic extreme.

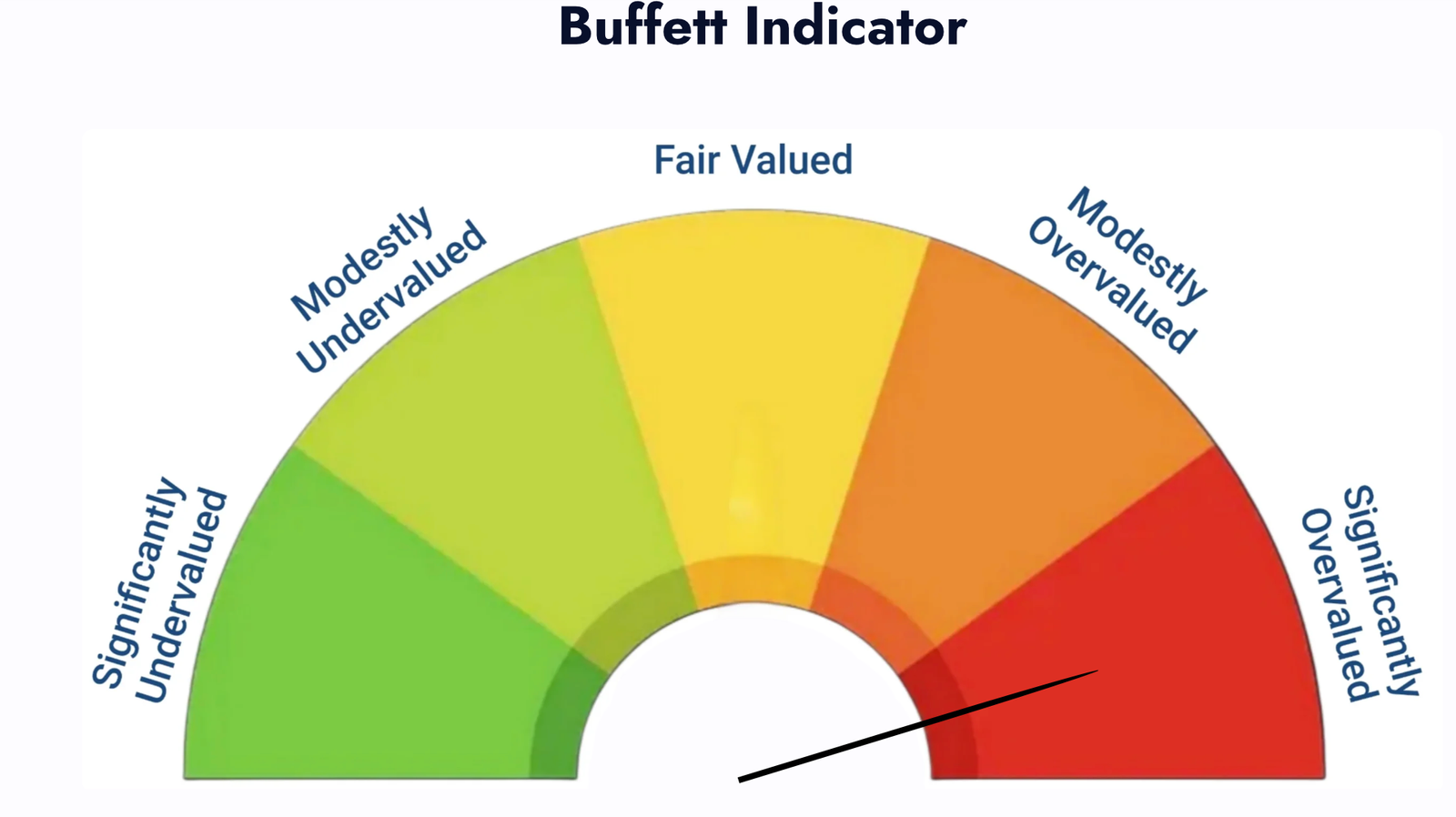

According to the latest data, the Buffett Indicator—which compares total U.S. market cap to GDP—is now at 208%.

That’s not just high. It’s off the charts:

| Market Cap / GDP Ratio | Valuation Category |

|---|---|

| ≤ 86% | Significantly Undervalued |

| 86% – 111% | Modestly Undervalued |

| 111% – 135% | Fair Valued |

| 135% – 160% | Modestly Overvalued |

| > 160% | Significantly Overvalued |

Where are we today (July 8, 2025)?

→ 208%. That’s deeper into overvalued territory than the peak of the dot-com bubble.

Most investors feel it. Few know what to do with it.

You might be thinking: “Sure, valuations are high—but the market keeps going up. Why fight the trend?”

And that’s what makes this moment so dangerous.

Signals are flashing red, but momentum is green. Traditional feedback loops are broken. Government stimulus, low real rates, and mega-cap dominance have stretched this cycle far beyond normal. ETF flows can exacerbate the bubble.

But no cycle lasts forever.

What matters now isn’t prediction—it’s discipline.

And no framework is more relevant right now than value investing.

Why It’s Time for Every Investor to Think Like a Value Investor

Value investing isn’t about being contrarian or old-fashioned. It’s about having a system grounded in real fundamentals, not market noise.

In today’s environment, it’s not just smart—it’s essential.

Here’s the simple framework I recommend for navigating this distorted market with clarity and control:

1. Focus on undervalued companies with real financial strength.

If you’re relying on the market to bail you out, you’re taking on more risk than you think.

Instead, look for businesses that:

- Are trading below their intrinsic value.

- Generate strong and predictable free cash flow.

- Have low debt, high return on equity, and pricing power.

- Can grow earnings without hype or dilution.

These are the businesses that endure downturns and thrive in recoveries. In overvalued markets, quality isn’t a luxury—it’s your defense.

2. Only hold cash when you have no conviction.

Let’s be clear: this isn’t a call to sit in cash out of fear.

But if you can’t find a high-quality business trading at a reasonable price, it’s okay to wait. Cash, in this context, isn’t a bet against the market—it’s a commitment to discipline.

When a real opportunity appears, you want to move—not hesitate.

3. Prepare to act—before others are forced to.

Don’t wait for panic to build your plan.

Now is the time to:

- Identify your high-conviction targets

- Understand their financials, risks, and long-term moat

- Define your buy prices based on conservative assumptions

When volatility returns—and it will—those with clarity and cash will be ready. Everyone else will be reactive.

You don’t need to time the market. You need to respect it.

Yes, the Buffett Indicator has been elevated for a while.

Yes, the market has continued higher.

But history is clear: valuation always matters eventually. And when it does, those who stuck to real investing principles come out ahead.

So this isn’t the time for fear—but it is the time for filters.

Smart investing starts with seeing the signal through the noise.

Now more than ever, that signal is value.

That’s exactly why I built Alert Invest.

We track the moves of the world’s best value investors—Buffett, Greenblatt, Pabrai, and more.

Every time they buy or increase their position, we break it down:

- The company they’re buying

- Why it may be undervalued

- What you should consider before acting

It’s like having a professional due diligence screen—before the market catches on.

➡️ Want to see where the world’s top value investors are putting their money today?👇

📈 📩 Get Alerts When Top Value Investors Buy

Build wealth by tracking top investors’ trades, rooted in strong fundamentals.

- 🔔 Instant Alerts: Catch undervalued stocks.

- ⏱️ Save Time: Skip deep research.