Value Fund Alert: Keurig Dr Pepper

Top Value Investors Signal Confidence in KDP

Dear Valued Investor,

We’re excited to share a notable investment alert: top value funds, including Oakmark (Bill Nygren) and SCCM Enhanced Equity Income Fund, have recently purchased shares of Keurig Dr Pepper Inc. (NASDAQ: KDP). Below, we dive into why KDP is gaining traction and what makes it a noteworthy investment case.

Company: Keurig Dr Pepper Inc. (NASDAQ: KDP)

Fund Managers: Bill Nygren (Oakmark), SCCM Enhanced Equity Income Fund

Action: Buy

Current Price: $32.97

Forward P/E: ~16.7x

Dividend Yield: ~2.8%

Not financial advice. Do your own research.

Oakmark’s Investment Philosophy

Oakmark Funds, led by Bill Nygren, follows a disciplined value investing approach, targeting companies trading below intrinsic value. With over 30 years of expertise, Oakmark focuses on businesses with strong fundamentals, shareholder-oriented management, and long-term growth potential. Their strategy has delivered a 11.73% annualized return since 1991, outperforming the S&P 500’s 9.57% (as of March 31, 2025).

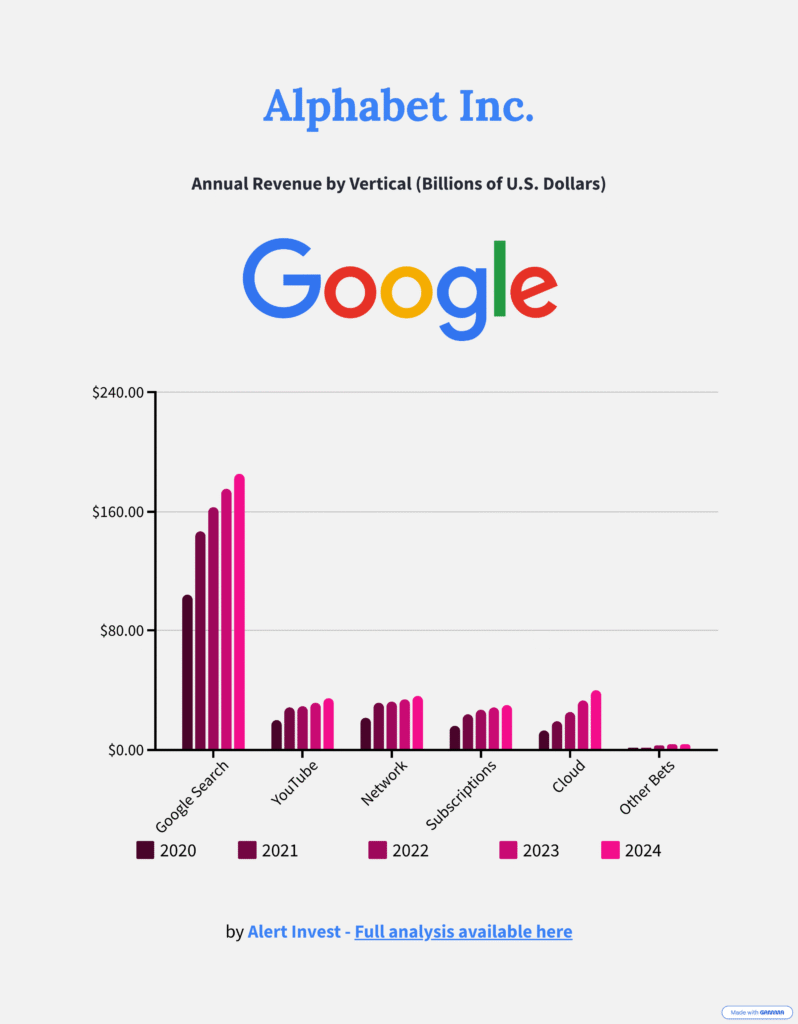

Company Overview

Keurig Dr Pepper (KDP) is a leading North American beverage company, formed in 2018 from the merger of Keurig Green Mountain and Dr Pepper Snapple. With over 125 brands, including Dr Pepper, Snapple, 7UP, and Keurig coffee systems, KDP generates over $15B in annual revenue. Its diverse portfolio spans soft drinks, coffee, juices, and energy drinks, supported by a robust distribution network.

- 29,000 employees

- Present in North America and growing internationally

- #1 single-serve coffee brewer in North America

- 60% stake in GHOST Energy, expanding into energy drinks

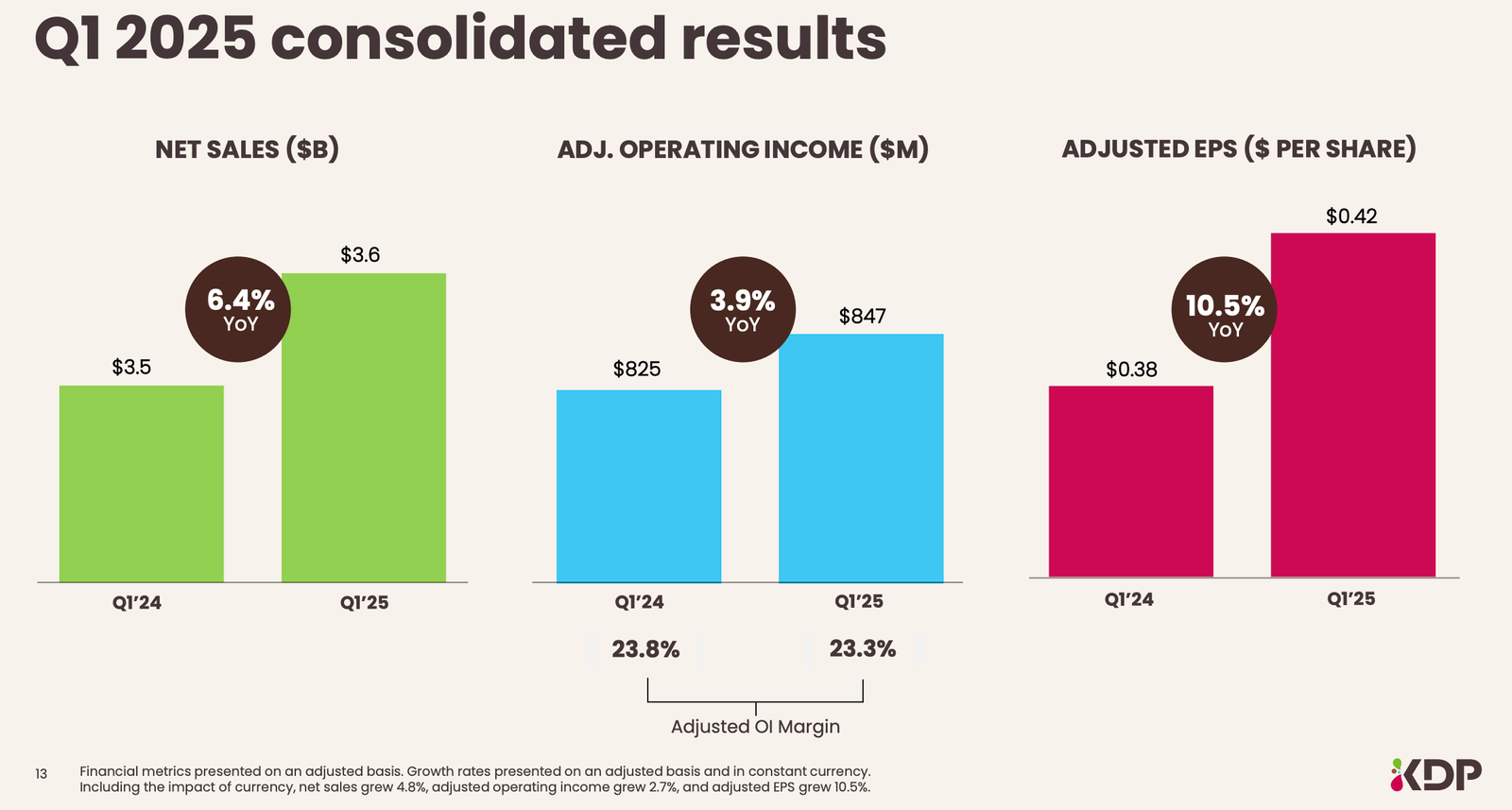

Company presentation – Q1 Result

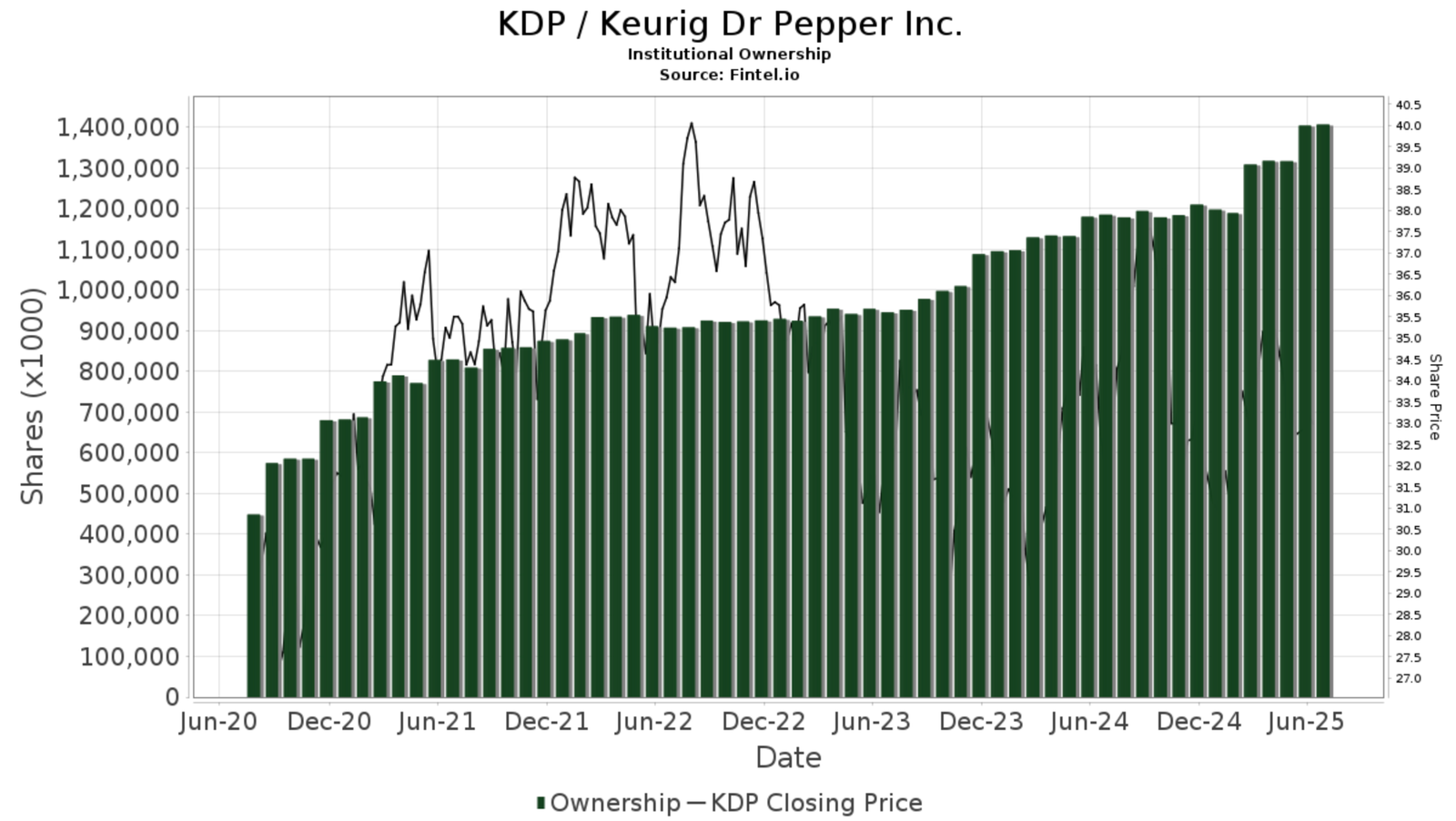

Fund Sentiment

- Institutional Ownership: 1,660 funds hold KDP, up 5.13% from last quarter.

- Portfolio Weight: Average fund allocation to KDP is 0.29%, up 8.15%.

- Share Growth: Institutional shares increased 10.39% to 1,316,403K.

- Bullish Outlook: Put/call ratio of 0.68 suggests positive sentiment.

Fund Ownership in KDP (Source: Fintel)

Why KDP Presents a Notable Investment

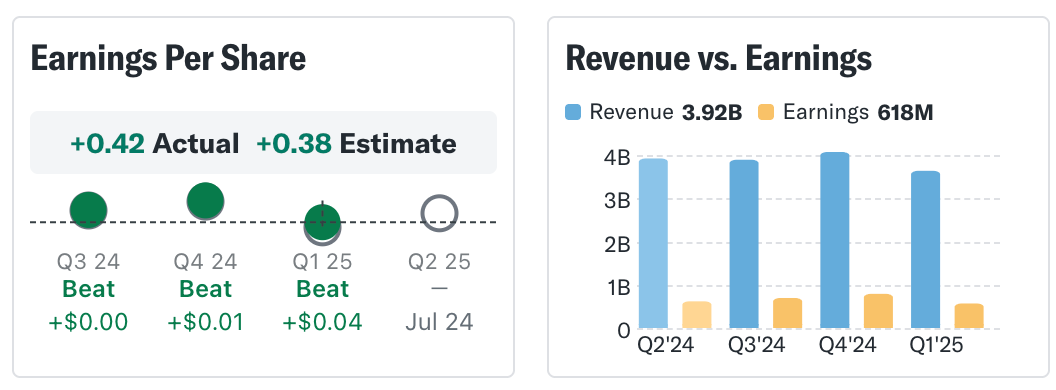

KDP is gaining traction due to its strong financial performance and strategic initiatives. Q1 2025 saw 4.8% net sales growth to $3.6B and 10.5% EPS growth to $0.42, beating analyst expectations of $0.38. Key drivers include:

- GHOST Energy Acquisition: 60% stake acquired, bolstering KDP’s position in the high-growth energy drink market.

- Innovation: New flavors like Dr Pepper Blackberry enhance core brand appeal.

- Distribution Strength: Extensive direct-store-delivery network boosts market reach.

- Institutional Interest: Hedge fund holdings rose from 39 to 54 in Q1 2025.

Company presentation – Q1

Valuation Snapshot

Forward P/E reflects growth potential; trailing P/E is 33% below 10-year average. Data as of June 9, 2025.

Margin of Safety

KDP offers a compelling dual margin of safety for value investors, combining operational stability and a reasonable valuation:

- Operational Stability: High gross margins (59.2%) and non-cyclical demand for coffee and soft drinks ensure low breakeven risk, supported by strong brand loyalty.

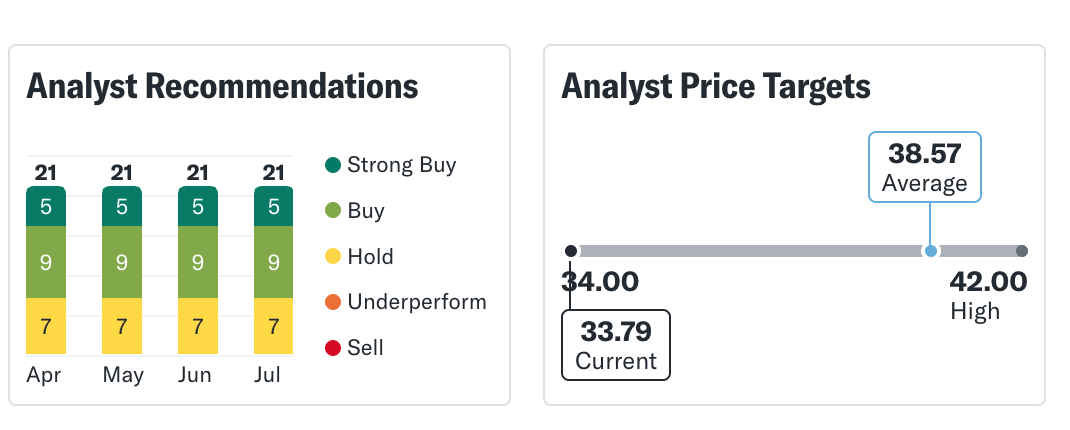

- Fair Valuation: Forward P/E of ~16.7x, 33% below KDP’s 10-year average, reflects a fair price with ~20% upside based on analyst targets (e.g., Morgan Stanley $40.00, UBS $42.00, June 2025).

- Stable Cash Flows: Consumer staples model and 2.8% dividend yield provide consistent returns for long-term.

- Low Financial Risk: Debt-to-equity ratio of 0.59x is lower than peers like Coca-Cola (1.87x) and PepsiCo (2.64x).

- Institutional Confidence: Hedge fund holdings increased from 39 to 54 in Q1 2025, signaling strong backing.

Data from MarketBeat, analyst reports, Keurig Dr Pepper Q1 2025 Earnings Presentation (April 2025).

Competitive Landscape

KDP competes in a dynamic beverage market against giants and niche players.

| Company | Key Strength | Relative Threat |

|---|---|---|

| Keurig Dr Pepper | #1 single-serve coffee, diverse portfolio | Our focus |

| Coca-Cola (KO) | Global brand equity, vast distribution | ⭐⭐⭐⭐⭐ |

| PepsiCo (PEP) | Diversified food and beverage portfolio | ⭐⭐⭐⭐ |

| Monster Beverage (MNST) | Energy drink leadership | ⭐⭐⭐ |

Competitive Ratio Analysis

| Company | Revenue ($B) | Gross Margin % | P/E Ratio (x) | Debt-to-Equity | Div. Yield (%) |

|---|---|---|---|---|---|

| Keurig Dr Pepper | 3.6 | 59.2 | 29.17 | 0.59 | 2.8 |

| Coca-Cola | 11.3 | 39.8 | 28.13 | 1.87 | 2.7 |

| PepsiCo | 22.7 | 55.7 | 22.56 | 2.64 | 4.17 |

| Monster Beverage | 1.9 | 54.6 | 41.93 | 0.03 | 0.0 |

Revenue reflects Q1 2025; other metrics as of June 2025. Data from MarketBeat, company reports.

Geographical Diversification

KDP’s operations focus on North America, with growing international presence in Mexico and Canada. In Q1 2025, international net sales grew 9.2% in constant currency, driven by strong volume in Mexico. The company leverages its direct-store-delivery network to expand emerging brands like GHOST Energy, targeting mid-single-digit revenue growth globally.

Analyst Consensus

Analyst Ratings for KDP (Source: Yahoo Finance)

KDP Earning

Earning per share (Source: Yahoo finance)

Key Takeaways

- Investor Confidence: Top funds like Oakmark and SCCM are buying KDP, with hedge fund holdings up from 39 to 54 in Q1 2025.

- Financial Growth: Q1 2025 net sales rose 4.8% to $3.6B, with 10.5% EPS growth to $0.42, beating forecasts.

- Strategic Expansion: GHOST Energy acquisition and new flavors strengthen KDP’s portfolio.

- Global Reach: International sales grew 9.2% in Q1 2025, led by Mexico and Canada.

- Dual Margin of Safety: High gross margins (59.2%) and stable demand ensure operational safety; forward P/E of ~16.7x offers fair valuation with ~20% upside.

📈 📩 Get Alerts When Top Value Investors Buy

Build wealth by tracking top investors’ trades, rooted in strong fundamentals.

- 🔔 Instant Alerts: Catch undervalued stocks.

- ⏱️ Save Time: Skip deep research.